Five years ago this September, the Lehman Brothers investment bank collapsed. Markets around the world froze until Western governments devised a massive bailout plan that kept investors from pulling trillions out of the global financial system and precipitating a worldwide depression. The financial crisis helped propel Barack Obama to the presidency. In his inaugural address, Obama said that the crisis was a reminder that “without a watchful eye, the market can spin out of control.” After the February 2009 stimulus law and the March 2010 “Obamacare” health-insurance overhaul, the Dodd-Frank financial-reform act of July 2010—meant to sharpen the vision of that “watchful eye”—became Obama’s third signature legislative victory. “The American people will never again be asked to foot the bill for Wall Street’s mistakes,” Obama said as he signed the bill into law. “There will be no more tax-funded bailouts—period.” To applause, he added that “there will be new rules to make clear that no firm is somehow protected because it is ‘too big to fail.’ ”

But three years later, “too big to fail” lives on. “There’s a growing bipartisan consensus that the Dodd-Frank Act regrettably did not end the ‘too-big-to-fail’ phenomenon or its consequent bailouts,” Texas congressman Jeb Hensarling, head of the House financial-services committee, said just before Dodd-Frank’s third anniversary this summer. Republicans aren’t the only ones saying so. Elizabeth Warren, the new Democratic senator from Massachusetts, recently introduced her own “end too big to fail” bill, implicitly suggesting that Dodd-Frank did not fix the problem. At one congressional hearing after another, independent expert witnesses, as well as top officials from the Obama administration, have admitted that there is still no structure in place that would allow large financial institutions to go under without risking an economic meltdown. What went wrong with Dodd-Frank, and how can the problems be fixed?

Finally, a reason to check your email.

Sign up for our free newsletter today.

Piles of books have tried to explain why Wall Street collapsed in 2008 (see “Surveying the Wreckage,” Summer 2010), but most agree on a few fundamental causes. First, American policy encouraged borrowers and lenders to pump too much money into housing—distorting the economy, inflating a bubble, and leaving borrowers (small homeowners) as well as lenders (large financial institutions and investors) vulnerable to a sudden downturn. Second, banks and other financial firms borrowed far too much money relative to capital—that is, to the non-borrowed money that they had on hand to help absorb any unexpected losses. And they could do this partly because they used structured financing. Through securitization, for example, financial firms could take lots of loans and structure them into bonds, which they maintained were safer than the individual loans because some bond investors agreed to take losses before other bond investors would. Because the banks had supposedly transformed risky bets into safe ventures, they didn’t need to hold much capital, regulators believed—after all, the chance of incurring losses was minimal to nonexistent.

Third, and relatedly, financial firms could circumvent open, transparent markets by using new types of financial instruments to take enormous bets with little or no capital down. They could do this largely because a 2000 law had prohibited regulators from imposing capital and transparency requirements on new derivatives, or “swaps,” markets—a dangerous gap, especially since regulators limited borrowing in nearly all other securities and derivatives markets.

Last, and perhaps most important, financial institutions and their investors assumed—correctly—that the government would save them in any crisis. Nearly three decades of history, from the first financial bailouts of the Reagan years to similar rescues during the Clinton era, backed them up (see “ ‘Too Big to Fail’ Must Die,” Summer 2009). Investors sounded no alarms when financial firms became too dependent on short-term financing, which could vanish at a moment’s notice, or when these firms used derivatives to take on trillions of dollars’ worth of risk, including the risk that derivatives “counterparties”—the institutions on the other side of the bet—would fail to make good on their promises.

Before the 2008 election, candidate Obama offered some sound prescriptions to these problems. In a speech at Cooper Union in New York that March before an audience that included Mayor Michael R. Bloomberg and former Federal Reserve chairman Paul Volcker, Obama suggested more robust bank supervision, higher capital requirements, and increased transparency. He also said that he would “streamline” many “overlapping and competing regulatory agencies.” With such reforms, Obama said, the country could “ensure that financial institutions around the world are subject to similar rules of the road, both to make the system more stable and to keep our financial institutions competitive.”

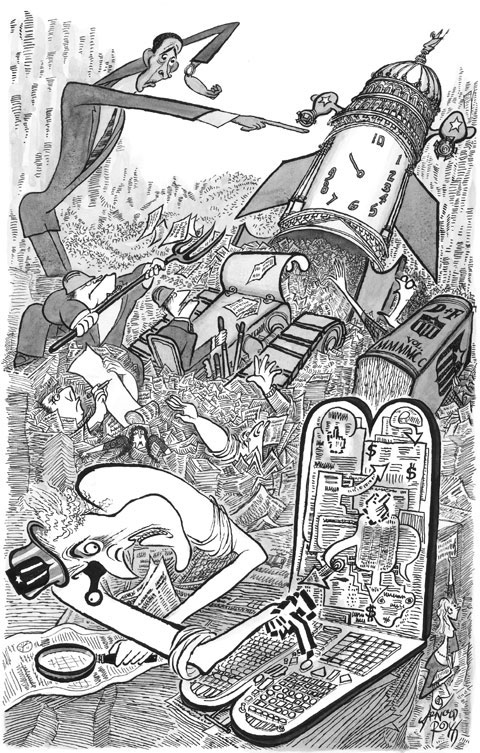

After Obama became president, though, it took Congress more than two years to pass Dodd-Frank, named for former senator Chris Dodd of Connecticut and former congressman Barney Frank of Massachusetts, the sponsors of the law in each house. The law takes up 849 pages—that’s more than twice as long as the 407-page stimulus law and only 57 pages shorter than the Obamacare legislation. By contrast, the Sarbanes-Oxley law of 2002—Congress’s post-Enron attempt to fix financial markets—is just 66 pages. Going further back, the Securities Act of 1933—a cornerstone of financial regulation that helped prevent meltdowns for five decades, until financial lobbying began to erode its power—runs just 93 pages. The Glass-Steagall Act, another 1933 law that separated long-term commercial banking from shorter-term investment banking, ensuring that the risk of one activity didn’t infect the other, totaled 53 pages. And even after decades’ worth of amendments, the Securities Exchange Act of 1934 adds up to only 371 pages.

That Dodd-Frank tried to do too much at once is evident not only in its length but also in its mind-numbing complexity and vast scope. Dodd-Frank addresses everything from how to achieve “financial stability” to how to wind down failing firms through an “orderly liquidation authority” to how to regulate derivatives as well as mortgages. Almost as an afterthought, the law creates an enormous new bureaucracy, the Bureau of Consumer Financial Protection. The CFPB, as it’s commonly known, is so potentially consequential that its sponsors should have introduced it as a separate piece of legislation (see “Dodd-Frank’s Protection Racket,” Summer 2012).

Dodd-Frank also creates 17 smaller bureaucracies, a list of which reads like a parody of overactive government: the Financial Stability Oversight Council (FSOC); the Office of Financial Research (OFR); the Investor Advisory Committee (IAC); the Research and Analysis Center (RAC); the Financial Research Fund (FRF); the Orderly Liquidation Authority (OLA); the Orderly Liquidation Fund (OLF); the Office of Minority and Women Inclusion (OMWI); the Federal Insurance Office (FIO); the Office of Credit Ratings (OCR); the Office of Municipal Securities (OMS); the Office of Fair Lending and Equal Opportunity (OFLEO); the Office of Financial Education (OFE); the Office of Service Member Affairs (OSMA); the Office of Financial Protection for Older Americans (OFPOA); the Consumer Advisory Board (CAB); and the Private Education Loan Ombudsman (PELO).

The most competent regulators would have had trouble setting up, staffing, and overseeing such a sprawl of new offices, even without the need to investigate precrisis wrongdoing and learn from recent mistakes. But posting help-wanted notices and ordering water coolers was the easy part. Dodd-Frank required regulators to write 398 separate rules, many as complex as the law itself. Though Dodd-Frank is the law of the land, regulators haven’t been able to apply it yet, since they need to figure out how to write all its rules and enforce them. (Obamacare has run into the same complexity problem. The law has been on the books for more than three years, but regulators have delayed implementation of key parts of it, including the requirement for employers to provide health care for their workers.)

Dodd-Frank “is better conceived as a mandate to regulatory agencies” to write rules than as “a definitive piece of prescriptive legislation,” says Louise Bennetts, associate director of financial-regulation studies at the Cato Institute and former senior associate at Davis Polk & Wardwell’s New York law office. The rule-making undertaking has so far produced—or rather, consumed—18,789 pages of text, containing 15 million words, according to a report that Davis Polk prepared for its clients on Dodd-Frank’s third anniversary. Yet flummoxed rule-makers, missing deadline after deadline, are only 40 percent finished with their mammoth task. As Davis Polk notes, of the 280 now-expired deadlines that Congress set, regulators have failed to meet 172; they haven’t even announced proposals for another 64. Treasury officials insist that the work is accelerating, but the slow pace “has been remarkably consistent,” Davis Polk observes.

The long wait would be acceptable if regulators were creating a solid body of governance that would stand the test of time. Instead, the rule-making is only making things more confusing. “The uncertainty of the [Dodd-Frank] Act [is] not clarified by rule-making, but is, in fact, exacerbated,” says Bennetts. The financial industry remains in the dark on everything from new rules governing credit cards to what kinds of firms must submit to lower borrowing limits. Key terminology remains undefined or open to interpretation, Bennetts notes. The head of the CFPB, Richard Cordray, has refused to define the word “abusive” as laid out in the law. He’ll know it when he sees it, he says. Absent a definition, though, a loan underwriter may wonder: Is it abusive to offer a poor person with lousy credit and an unstable income a high-interest-rate credit card?

Regulators have spent nearly three and a half years trying to write the Volcker Rule, a provision that Obama once billed as the centerpiece of his financial-reform effort. The rule itself, championed by the former Federal Reserve chief, is straightforward. Banks that enjoy implicit taxpayer subsidies in the form of federally insured customer deposits and being able to borrow from the Federal Reserve in a crisis should not be permitted to make large, speculative, short-term bets in financial markets. Instead, they should confine themselves mostly to long-term lending activities and to traditional investment-banking practices, such as managing people’s money for a fee.

Volcker has criticized regulators for the delay in finalizing the rule, rather than blaming lawmakers for assigning them an impossible task. Congress specifically directed regulators to carve out an exception to the rule’s main premise, so that financial firms can “hedge” long-term lending activities. That is, if a bank’s officers think that a recession could cause borrowers to default, the bank could offset that risk by purchasing an investment that would perform well in a high-default environment. But regulators cannot readily determine what kinds of activities constitute hedging and what kinds constitute speculation. If a bank holds $1 billion in long-term farm loans and then decides to short-sell corn futures—in the expectation that corn prices would drop and that its borrowers would begin defaulting on their loans—is that hedging or speculation? Another problem is the sheer number of agencies that must coordinate on the Volcker Rule (and on others). Despite Obama’s rhetoric about streamlining regulators, dozens of individuals, if not hundreds, from the Federal Reserve, the FDIC, the Securities and Exchange Commission, and the Commodity Futures Trading Commission must agree not only on the creation of complex rules but also on their enforcement.

The regulators do deserve some blame. More forceful leadership at the Federal Reserve and the FDIC could have made a difference, notes Harvey Rosenblum, director of research at the Federal Reserve Bank of Dallas. He says that regulatory leadership should have told their staff: “The law is not workable, but it is our job to make it work.” He recalls that when he was part of a staff that helped design rules for the 1970 amendment to the Bank Holding Company Act—a major overhaul—they understood that they were to write no more than one page of rule for every page of law. Dodd-Frank is already at a 16-to-1 rules-to-pages ratio—and it’s not even half completed.

Even when regulators see their way to a clear definition of a rule, the results often leave much to be desired. Dodd-Frank, for example, directed the new CFPB to tell banks that they must assess consumers’ “ability to pay” mortgages before approving them. That sounds reasonable. But how did they define ability to pay? The regulators decided that an individual can borrow up to 43 percent of his income—highly inadvisable for almost anyone. Borrowing this heavily leaves little room for a spouse to lose a job, say. Regulators should have established a requirement for a mortgage down payment, big enough to provide home borrowers with a large cushion of non-borrowed money invested in their homes should they run into trouble. (Americans followed such guidelines informally until the 1980s, when affordable-housing goals, as well as a desire for larger profits on the part of federally guaranteed housing agencies Fannie Mae and Freddie Mac, eroded the standards.) Worse, the mortgage rule has important exceptions. Small banks in underserved areas, for example, can still issue risky “balloon” mortgages, which require a huge payment at the end of their term, rather than amortizing steadily over years. Clearly, then, the mortgage rule is riddled with loopholes that undermine its purpose: to protect people from borrowing too much. Congress wants to look tough on mortgage lenders while continuing to let easy credit prop up the economy; regulators have obliged.

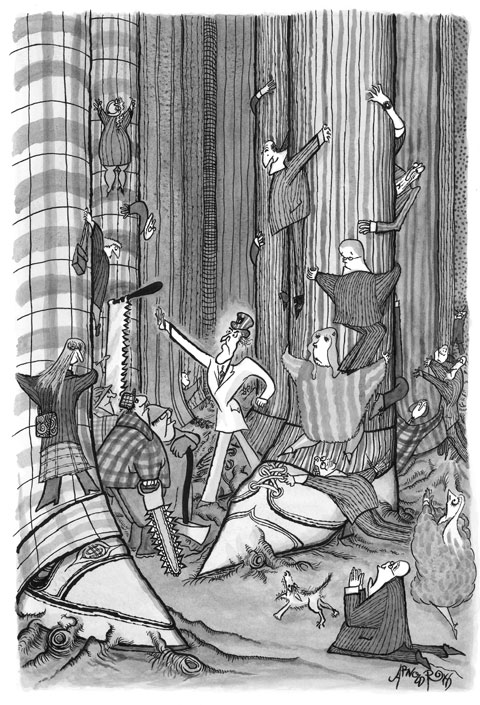

Dodd-Frank’s biggest failure is to have perpetuated too big to fail. The cataclysm of 2008 proved that Washington was terrified to let large or complex financial firms go bankrupt. But bankruptcy is a natural, healthy occurrence in a capitalist system. The goal should have been to figure out how to allow these firms to go under. Dodd-Frank’s approach, by contrast, was to make the world safe from bankruptcies, not for them. “Dodd-Frank kills the capitalist system,” says Rosenblum bluntly.

Dodd-Frank’s command-and-control ethos is epitomized by the Financial Stability Oversight Authority, a ten-member regulatory group that will “identify risks to the financial stability of the United States,” “promote market discipline,” and “respond to emerging threats to the stability of the U.S. financial system.” But these three things don’t go together. The FSOC’s work in monitoring the nation’s largest financial institutions contravenes its mandate to ensure market discipline. Why should investors monitor big firms if the government is already doing it for them? “As soon as a financial institution is designated as systemically important” by the FSOC, Dallas Fed president Richard Fisher told the House financial-services committee this June, “it is viewed by the market as being the first to be saved.” The SIFIs—the law’s “systemically important financial institutions”—thus “occupy a privileged space,” Fisher added.

Such privilege makes it exceedingly difficult for free markets to reverse a decades-long trend. In 1990, Fisher notes, the nation’s four biggest banks had $519 billion in assets, or 9 percent of gross domestic product. By 2011, they had $7.5 trillion, or 50 percent of GDP. “We have a structure that is not a free-market structure,” concurs Thomas Hoenig, vice chairman of the FDIC. “It is heavily subsidized”—at least $83 billion annually in artificially cheap borrowing costs, according to a Bloomberg View analysis. Further, if the FSOC misses a big risk and a firm fails because of this oversight, whose fault is that? Congress has ensured that it is the government’s fault just as much as the firm’s—hardly a blow for market discipline.

In vesting regulators with the power to chase moving threats, Congress and the president have also sowed uncertainty in the financial system, making it hard for financial firms to plan ahead and thus hampering economic recovery. As Cato’s Bennetts notes, the law has awarded overlapping jurisdiction to regulators, “making it challenging for the private sector to know exactly which agencies they are answerable to and why.” Hester Peirce, senior research fellow at George Mason University’s Mercatus Center, concurs. “I’m most concerned that [regulators] get to pick their own jurisdiction,” she says. The Fed, for example, can decide that it wants to regulate insurance firms by getting the FSOC to declare them systemic risks. Few observers may object to regulators policing the insurer AIG, which received a colossal bailout five years ago. But what if their next target is a large asset-management firm like BlackRock (or, perhaps, a public pension fund like Cal-PERS)? The point is not that firms should escape regulation but that they shouldn’t face unpredictable regulation.

The law also imposes a burden on large or complex financial firms that contravenes what should be their paramount duty: to protect their own investors from loss. Dodd-Frank mandates not only that systemically important firms protect themselves but also that they protect the rest of the financial system and the economy from “systemic risk.” But as Peirce notes, “no one knows what that is.” If a firm’s bankruptcy triggered a 10 percent stock-market fall, would such an outcome be too systemically risky to accept? The government “should want institutions to think of their own risks,” says Peirce, who previously served as senior counsel to Senator Richard Shelby’s staff on the Senate banking committee. The current approach “sounds very grand and important,” she says, “but what matters is what individual actors are doing.” How can the government expect financial firms that can’t foresee their own future losses to predict the losses of other firms and how they might harm the economy?

Dodd-Frank did create a way for a large financial firm to fail in the unlikely event that the nation’s all-knowing overseers miss something—but under the law’s Orderly Liquidation Authority, the firm would not declare insolvency. Instead, the FDIC would take it over. As Fisher said in his June testimony, the OLA process bears little resemblance to bankruptcy. In a real bankruptcy, a neutral judge (one hopes) applies a consistent body of law to creditors and debtors alike. In orderly liquidation, regulators could use Treasury funds to favor specific institutions, injecting money from the Orderly Liquidation Fund into them and keeping them going. “Failed companies [can be] artificially kept alive . . . for up to five years,” said Fisher. “To us, this looks, sounds, and tastes like a taxpayer bailout,” he observed. Five years is enough time for a firm that should have failed to resuscitate itself, especially with taxpayer life support. Five years after Lehman, companies such as AIG, Citigroup, and even Fannie Mae have become profitable again. The government could take over a large firm and wait out an economic cycle, with help from government-controlled low interest rates. And though Dodd-Frank constrains regulators’ ability to treat some creditors better than others, it makes room for exceptions. The FDIC could favor one creditor over another if it thought that doing so would improve all creditors’ recovery—likely meaning that the FDIC would protect short-term creditors to prevent them from fleeing.

Dodd-Frank’s supporters claim that the OLA mechanism isn’t a bailout because the financial industry, not taxpayers, would repay any money advanced. Indeed, all large financial firms would have to help repay a government bailout of a failed financial firm. But collectivizing losses throughout an industry doesn’t promote market discipline. Investors in, say, JPMorgan Chase know that should the firm fail, regulators now have the authority under Dodd-Frank to force its competitors to protect its short-term creditors. Perhaps this is why investors have shrugged off findings that Chase misled its board about the extent of the losses it suffered last year on its infamous “London Whale” bet. They know that in a crisis, the government and Chase’s rivals will be there to help out.

Because Dodd-Frank enshrined too big to fail, the law’s good provisions are less effective than they might be. Regulators have spent the past few years reducing the amount of money that financial firms can borrow and warning financial institutions about their reliance on short-term funding—both good developments. Regulators have also put in place better derivatives-markets rules. But rules can’t do everything. It’s investors who must pull back from short-term lending to large financial institutions. They have little motive to do so, though, when they know that the large financial institutions into which they pour their money are still permanent wards of the state.

The law’s staunchest champions—such as California congresswoman Maxine Waters, the Democrats’ ranking member on the House’s financial-services committee—continue to defend it. Responding to Hensarling’s and others’ assertions that Dodd-Frank only entrenched too big to fail, Waters said in June that “not enough attention has been paid to the actual legislated text. . . . I would encourage my colleagues to read the law.” She was untroubled by Fisher’s testimony that the law, in important places, conflicts with itself. For example, the law says that money from the OLF should be “sufficient” to maintain a failing firm, but it also contains provisions “if a shortfall remains.” Asked Fisher rhetorically: “How can it be ‘sufficient’ if a shortfall remains?” And speaking of regulators’ ability to use these government funds in a crisis, Fisher concluded: “It is not not taxpayer-funded.” (The money comes from the government, and thus the taxpayers.) “If anyone can figure out what Dodd-Frank says, I’ll give them the Congressional medal,” says Rosenblum.

Such confusions are reflected by the discomfort of the technocrats and bureaucrats who must carry out the law. Hoenig told Congress this summer that the OLA was “designed for an idiosyncratic event.” He warned: “If you have a systemic meltdown, I feel pretty confident” that regulators would have to come back to Congress for another law, just as Congress had to pass the Troubled Asset Relief Program (TARP) under emergency conditions in October 2008. Gary Gensler, the commodities regulator, points out that, while derivatives rules are improved, regulatory agencies still can’t ensure that non-bank companies—including agricultural firms—aren’t using too much borrowed money in derivatives markets. SEC chairwoman Mary Jo White, speaking before Congress this summer on the rule-making process, said that “many of [the rules] have a great deal of complexity.”

Treasury secretary Jacob Lew gingerly told Congress during a May 2013 update that “getting Dodd-Frank implemented is still a fair amount of work.” On the procedures that are supposed to allow financial firms to fail in an orderly fashion, he said: “I think the challenge is now to make sure that we know that those can work. . . . The operational issues are not insignificant.” This is testimony-speak for: “We have no idea what could happen.” Somewhat obliquely, Lew concluded that we’re “still determining how to set the levels in various areas” so that “in the end we’ll be able to say that too big to fail has ended.” Of course, Lew can hardly criticize Congress or his boss. But listen carefully, and the people who have studied this law closest seem skeptical about it, or worse. Other D.C. insiders, including Daniel Tarullo, an Obama appointee to the Fed’s board of governors, have warned that the financial system remains too dependent on short-term funding and thus vulnerable to a massive run. As New Jersey congressman Scott Garrett said at the summer hearing, “You can’t on the one hand say that banks are no longer too big to fail and then on the other hand bemoan the fact that they still are.”

Perhaps most damningly, former Fed chairman Volcker complained publicly in May that “it shouldn’t take three years to make a regulation.” In August, Obama held a private meeting with key financial regulators from the Fed, the Treasury, and other agencies to urge faster implementation. The president wanted to “convey to them the sense of urgency that he feels” on getting Dodd-Frank to work, a White House official told Bloomberg News.

All this uncertainty was unnecessary. The nation did not need a sweeping new financial regime; it needed incremental change to fix the specific things that went wrong before 2008.

First, Obama should have asked Congress to repeal the 2000 law that prohibited regulation of new derivatives markets, so that authorities could impose debt and reporting requirements on them. Second, he should have directed the Federal Reserve, the FDIC, and other regulators to impose higher capital requirements on financial institutions, and to do so more consistently—that is, without undue favoritism to mortgage and government securities—so that the financial system would not get itself in trouble again, thanks to government directives on what was “safe” and what wasn’t. Third, regulators could have used capital and liquidity requirements to wean financial firms from their dependence on short-term investors, reducing the risk that such investors would all flee in a crisis. Fourth, Congress could have eased the risk of destabilizing bankruptcies by revising the bankruptcy law so that derivatives counterparties couldn’t pull all their money out of a bankrupt firm, as no other creditors could do. Congress could have completed financial reform by making clear to the financial industry that it would support regulatory agencies when they enforced existing laws, even in the face of industry opposition.

The Dallas Fed’s Rosenblum thinks that it will take another “disaster”—and perhaps another decade—before the public realizes that Dodd-Frank hasn’t worked and Congress finally “gets around to trying to get it right.” To that end, Rosenblum and his boss, Fisher, have proposed an alternative plan. Fisher is seeking a congressional sponsor for a five-page bill that would cut off any government guarantee or subsidy—including the ability to borrow from the Federal Reserve in a crisis—from all but the bread-and-butter commercial-banking operations of a financial firm. The reform would make “the counterparties to other parts” of the financial institution “simply sign an agreement that the government will never, ever rescue us,” he told Congress. Senator Warren has teamed up with John McCain and four other middle-of-the-road senators to propose a modern-day Glass-Steagall bill to separate investment banking from commercial banking; the bill currently runs just 30 pages. Louisiana Republican senator David Vitter has introduced a bill to beef up capital requirements substantially for the biggest banks. More members of Congress are learning that it’s not political suicide to point out that today’s financial industry escapes free-market discipline.

In a political sense, it’s the Democrats who should worry this time around. As late as 2012, a plurality of voters still blamed former president George W. Bush and Wall Street for the financial crisis and its recessionary aftermath. Fair enough. Next time, though, the world will remember that it was Obama and his party who promised to end too big to fail—and didn’t.