This year, after a quarter-century of relatively free-market governance of the economy, the only thing protecting Americans from the complete vaporization of the financial industry has been the United States government. Treasury secretary Hank Paulson has spent the past six months using the trillions of dollars in promises and loans that only the government is powerful enough to make to avert the immediate collapse of the insurance giant AIG and those two mortgage behemoths, Fannie Mae and Freddie Mac. Government officials had hoped that their actions would persuade the financial world’s private lenders, trading partners, and customers to stop fleeing financial institutions in a Depression-style terror. The efforts failed. As the private credit markets collapsed in September and early October, the government stepped in to guarantee new lending to banks and to provide new investment capital to financial firms so that the industry wouldn’t fail utterly and drag the rest of the economy down with it.

Contrast these extraordinary actions with the government’s calm response to another recent financial implosion that could have provoked a crisis of confidence. In mid-July, President Bush reassured a nation rattled by the sight of Californians lining up to withdraw money from the failing commercial bank IndyMac. “If you have a deposit in a commercial bank in America, your deposit is insured by the federal government up to $100,000,” he said. “My hope is that people take a deep breath and realize that their deposits are protected by our government.” Franklin Delano Roosevelt must have looked down from Campobello in the sky and smiled. Facing a potential panic, Bush had turned the public’s attention to the Federal Deposit Insurance Corporation (FDIC), a collective insurance program and a hallmark of FDR’s New Deal. In late September, an even bigger commercial bank, Washington Mutual, failed in a similarly orderly fashion.

Finally, a reason to check your email.

Sign up for our free newsletter today.

The FDIC’s success in controlling a modest part of the financial crisis shows that market regulation matters. But what kind of regulations work best? Each presidential candidate promises to sign legislation overhauling the financial regulatory system, but a President McCain or a President Obama will have a thicket of questions to get through. What’s broken about the existing regulatory system? Are our existing regulations, most of them seven decades old, still relevant? In financial risk-taking, who should be protected and from what? Do we want to protect big companies from the risk of failure—or do we want to protect the overall financial system? And what can’t regulations do? Until we ask these questions and get the right answers, the financial firms still standing can’t know what their future world will look like.

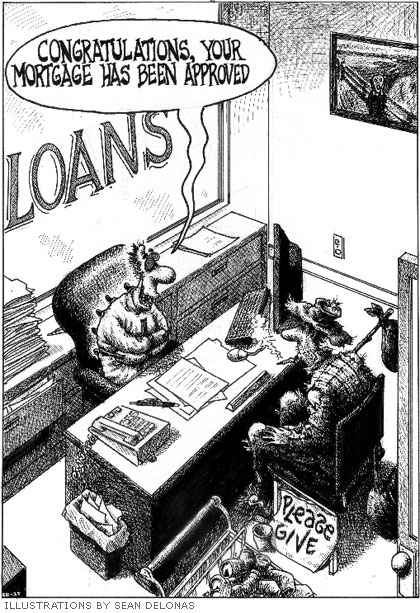

Important people who ride around in black cars would like you to think that the credit crisis is complicated. But all the acronyms—CDO, ABS, RMBS, CMBS, CMO, SIV—are just distractions. The reason for the crisis is simple: when you lend money to people who can’t pay it back, they won’t.

All right, it isn’t that simple. But it isn’t inexplicable, either. For the half-decade or so that ended in mid-2006, financial firms and investors, lulled by low inflation and interest rates, thought that there was no risk in increasing their lending exponentially to consumers and speculators seeking to buy houses, office buildings, and other assets. After all, mortgage lending over the past decade had seemed a sure thing, with ever-rising prices and few defaults. Plus, lenders had “securitized” mortgages and other types of loans—that is, transformed them into easily tradable securities. So if banks and other investors wanted their money back, they weren’t stuck for 30 years waiting for borrowers to pay them; instead, they could sell the loans to other eager investors, and then use the cash to make yet more loans. And even if a borrower couldn’t repay his loan, the collateral behind it—the house, in the case of mortgages—was a fail-safe.

Making this bet even more of a sure thing was the magic of complex financial engineering. If there were any losses, certain investors, who had agreed to take more risk in exchange for a higher return, would eat them. Everyone else would be safe unless there were lots of losses, and that would never happen—or so it was thought. For investment banks and global investment funds that did worry about some future catastrophe, insurance was on hand: companies like AIG offered “credit default” protection that would cover any losses.

The idea that lending was risk-free fed on itself. Easy money helped propel house and other asset prices skyward, because paying lots for a house or other asset was a cinch when people or institutions could borrow so freely. The rising prices—as well as the influx of people into the market seeking profits—then further expanded banks’ ability to make seemingly riskless loans. And so on.

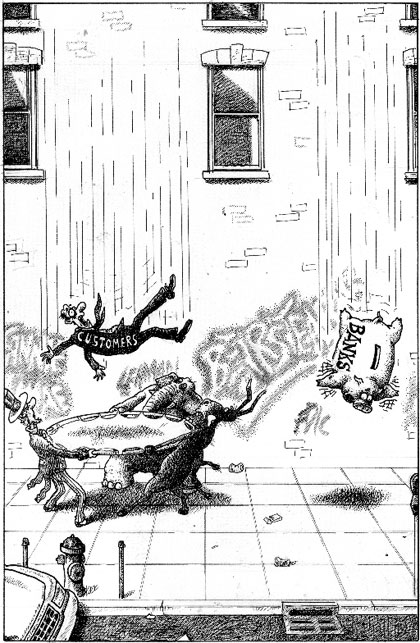

Then, when the tenuous assumptions behind the boom—ever-rising house prices, low interest rates, and the like—proved incorrect, it all went bust. Firms and investors that have lost hundreds of billions of dollars can’t do much new lending. Tens of millions of people owe money on homes suddenly worth much less than they were a short while ago. Uncertainty spreads like wildfire: Lehman Brothers and Bear Stearns collapsed partly because the companies’ own lenders and partners feared doing additional business with institutions that failed so spectacularly at their job of managing risk. In mid-September, investors even pulled their savings out of supposedly secure money-market mutual funds, fearing that they would lose money. At the same time, banks stopped lending to one another, spooked about one another’s books.

Severe asset and credit contractions gravely imperil the economy. If you can’t borrow cheaply through money markets to expand your small business, you can’t hire new workers. If you can’t borrow from your home equity to buy a flat-screen TV, you might not buy it. But if you can’t borrow at all because investors are scared to lend to anyone or any company, the economy grinds to a halt. Perhaps the deepest threat to the economy, however, is the misperception that the financial industry’s failure represents a failure of capitalism. In fact, capitalism worked, belatedly exposing the millennial financial industry for what it was and withholding capital from it so that a new, more robust, and possibly smaller financial sector can rise from the devastation.

The current financial hurricane bears a striking similarity to the late twenties and their aftermath. Back then, as with today’s crisis, easy borrowing had pushed stock prices up, and an assumption of ever-higher stock prices reinforced the easy lending environment. Then the inflated value of stocks and other assets went “pop,” and this deflation—worsened by misguided monetary and tax policy—spread to the real economy. Banks, having lost so much lending against asset values, were either unable or unwilling to lend much new money. Not trusting the banks with what was left, individuals and small businesses scrambled to pull their money out, and these “runs” caused more bank failures. Credit dried up, and assets, with no borrowing available to buy or improve them, continued to fall in value.

Seeking to prevent future bank runs and protect the crucial supplies of money and credit—exactly what’s necessary today—FDR signed into law the FDIC, which radically changed the way people thought about banking by guaranteeing small deposits at commercial banks. Even if a bank made some crummy bets, it now had a good chance of muddling through by attracting new depositors, who wouldn’t worry that they’d lose their shirts. If a bank did fail, customers could quickly get their money back, and the government would take over the bank and wind it down, ensuring that it couldn’t do further harm. In a contraction, the simple business of lending and borrowing, while it might slow or become pricier, could carry on; people wouldn’t stuff their money under their mattresses. In September, the orderly failure of Washington Mutual, the sixth-largest bank in the U.S., showed once again how well this system works.

By reducing one risk, though, the government conjured another: that the newly insured banks, liberated to some degree from customer scrutiny, would feel free to take greater risks themselves. The government thus had to protect taxpayers by containing this new risk, which it sought to do by insulating the banks, and hence the entire economy, from the worst effects of freewheeling market speculation. Even as Congress and FDR devised deposit insurance, they forbade commercial banks, which dealt most commonly with average customers and run-of-the-mill business borrowers—unlike investment banks, which dealt with big institutions and supposedly sophisticated lenders—from lending money to purchase stock. The feds also enacted the Glass-Steagall law, which forced the commercial banks to sell their securities affiliates, so that they couldn’t use customers’ money to underwrite or invest in stocks.

The regulatory principle of protecting the money and credit supplies from panic hasn’t diminished in importance since the thirties. But the financial world has changed dramatically. Once upon a time, if your local bank imploded, it meant that you might have a hard time getting a loan. But you didn’t much care what happened at East Coast investment banks. Over the past quarter-century or so, though, with the modernization of the financial industry and the globalization of financial markets, the big investment banks became just as responsible as commercial banks for the creation of consumer and business credit. When you borrowed money on your credit card, it was often because an investment bank had found an international client to “invest” in your credit-card debt; the same thing held with mortgages.

By 1999, Congress and President Clinton—along with armies of bank lobbyists—decided that the lines separating the financial worlds had blurred so much that Glass-Steagall was irrelevant. So they repealed it, though commercial banks would still operate under tight constraint. The Fed and other regulators require commercial-bank holding companies, for example, to keep on hand, in the form of quality capital and other reserves that investors can’t pull out in a crisis, about 10 percent of their total assets (that is, all the loans they’ve made to people and companies, as well as other investments). Such “capital requirements”—in effect, limits on borrowing—don’t guarantee that banks won’t fail, but they do give them more room for error and help cushion them against precipitous drops in confidence.

The lesson that both political parties missed in the repeal of Glass-Steagall wasn’t that it was too dangerous to allow commercial banks and securities banks to commingle, as many critics charge now. It was that the securities side of the business had grown just as vital to the economy as the closely regulated banking system. What nobody realized was that the government needed to protect the economy against runs on investment banks and other lightly regulated financial institutions—a shadow banking industry—just as it had with commercial banks decades earlier.

Long before the current crisis, the government missed warning signs that such protection was necessary. In 1998, failure threatened a company called Long-Term Capital Management—an unregulated hedge fund, not a very large firm, but exceedingly complex, with tens of billions invested in opaque securities and derivatives markets around the world. Bankruptcy would have forced it and its creditors to dump its investments on the market all at once, possibly setting off a global panic. So the Federal Reserve intervened to prevent LTCM from entering the normal bankruptcy process. But the government ultimately saw the episode as a one-time crisis rather than as evidence that the economy needed more protection from the new shadow finance.

Three years later, the government, and most other people, also got Enron wrong. How could a publicly traded financial company have used billions of dollars’ worth of murky borrowing structures to cloak itself in such mystery and fragility that it could suddenly and shockingly collapse, catching most observers unaware? Enron’s finances were so byzantine that the company’s CFO used them to steal money outright without detection. In the end, Enron’s creditors decided all at once that its opaquely structured assets weren’t worth what it had said they were worth—a portent of today. But after Enron collapsed, lawmakers and the president figured that once they had put CEO Jeffrey Skilling in jail and made the rest of the CEOs jump through a few more financial-reporting hoops, the rest of us were safe.

Regulators’ and bankers’ blindness to the dangers spotlighted by LTCM and Enron would imperil the entire global economy half a decade later, starting when Bear Stearns’s creditors, like Enron’s, lost faith in the firm’s assets and corporate structure, fleeing it and starting a six-month escape from the credit markets in general. Bear, with just 16 percent of the assets of a firm like Citigroup, wasn’t big, but it had ensnared the rest of the financial system in a dark web of derivative securities and short-term loans. Backing those loans were assets whose value would nose-dive—even more than in the then-burgeoning credit crisis—in a sudden, forced sale, so the feds stepped in and rescued Bear’s creditors by engineering a partly guaranteed sale of the firm to JPMorgan Chase.

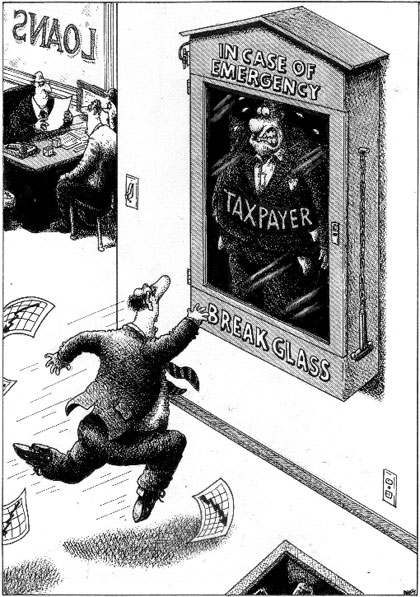

That was when elected officials, regulators, and bankers finally realized the scary extent of the systemic risks that the banking industry has created. In its effort to stanch the losses to the credit system, the Fed began in March to lend directly to investment banks rather than just to commercial banks. The White House then nationalized Fannie Mae and Freddie Mac in August, to bolster Asian investors’ waning confidence in the mortgage companies’ debt. Weeks later, it quasi-nationalized AIG, worrying that the firm’s bankruptcy would have meant defaults, or fears of defaults, on its half-trillion dollars’ worth of credit default insurance. Just days after that, in mid-September, the government had to offer a temporary guarantee of money-market funds, the first such guarantee it had extended since 1933. Weeks later, Congress passed a clumsy proposal to spend $700 billion buying bad assets from financial institutions to free them up to make new loans. The promise of this program having failed to thaw credit markets, Paulson dedicated $250 billion of the money to pump capital directly into banks, while the Federal Reserve started lending directly to non-bank businesses. The government further guaranteed nearly all new lending to banks, effectively nationalizing the industry to liquefy those dangerously frozen markets.

Could free markets have sorted out this mess instead? Sure, but only by destroying the remains of the financial system and possibly putting millions of people out of work. It’s clear that society won’t stand by passively while such a correction occurs.

In creating an ad hoc safety net for huge swaths of the shadow financial system, Washington is a step closer to recognizing that the economy needs the same kind of protections from the securities business that it enjoys from the FDIC-regulated banking system. But the government’s panicked actions could distort the economy after recovery. By protecting lenders at financial firms, it has given investors an incentive to provide debt, not equity, to those firms, when they need to carry less debt in the future. And by showing that it will step in to protect financial firms that are too big, or too complex, to fail, the government may be giving small firms an incentive to grow bigger and more complicated, just when rational markets would prefer that they get smaller and simpler.

Above all, the government threatens to create zombie financial institutions that would be dead if not for the extraordinary new privilege of relying on the taxpayer in a crisis, a privilege that investors may assume will be available in the next crisis as well. The economy will suffer if, after the acute panic has calmed, the implied promise of future government guarantees persuades lenders to trust the zombies over other, more deserving industries. Or say you’re a factory worker, and your company winds up getting bought out with money lent by a bank that’s only in business because the government propped it up back in 2008 and will likely do so again in the future. When your boss starts slashing jobs, your opinion of democratic capitalism is likely to sink.

How can a new administration in Washington put in place explicit, predictable ways to protect the economy from financial-sector failure in the future, now that it clearly understands that the markets aren’t up to policing themselves without threatening severe economic disruption? For starters, it must avoid the pernicious but seductive idea that since failure has proved so dangerous, we have to prevent it.

Paulson, for instance, has talked about creating a federal “market stability regulator” to smooth out economic disruptions. But a healthy economy is an unstable one, with lots of “creative destruction”—that is, millions of jobs destroyed and created each year. (Stagnant economies, by contrast, are nice and stable.) A “stability regulator” might police the markets too aggressively, mistaking valuable innovation for a dangerous bubble and thus hurting prosperity. A regulator might also lull bankers and investors into thinking that we’re safer when we’re not. Regulators are far from infallible. Coupled with the implied promise of Fed lending in the next crisis, Washington could give life to another perilous government-guaranteed risk-taker, just as it did long ago with Fannie Mae and Freddie Mac.

If we’re to remain a relatively free-market economy, we must allow bad companies to fail, even when—maybe especially when—they’re big or complicated. The government needs to protect the economy from those failing institutions, not protect the institutions from the economy by making zombies out of them. Large, complex financial institutions, says Jay Westbrook, a business-law professor at the University of Texas at Austin, should be “too big to fail quickly”—not too big to fail at all.

We won half of this battle decades ago. Contrary to popular myth, Securities and Exchange Commission regulations already adequately shield the customers even of complicated investment banks. Lehman’s plain old customers, who just kept their own investments at the company—as opposed to its lenders and trading counterparties, who depended on the firm’s credit—were safe when it went bankrupt. If Bear Stearns had gone bankrupt, its customers would have been safe, too, as the SEC has attested. Investment banks and brokerage houses must already segregate customer assets, so they can’t borrow against your securities without explicit permission. When a brokerage firm goes under, regulators simply transfer its customer assets to another bank. If the firm has committed fraud and not segregated these assets, a nonprofit company created by Congress, the Securities Investor Protection Corporation, guarantees 100 percent of them, up to $500,000. “In the overwhelming majority of instances, the system does work,” says Stephen Harbeck, SIPC’s chief. In the worldwide Lehman bankruptcy, the American system of protecting and transferring customer assets has worked much better than the British system.

Still, this arrangement needs updating. It’s not clear that $500,000 remains sufficient protection in cases of fraud. It might be worth increasing that amount to several million dollars, which would encourage bigger customers to keep their investments warehoused at a firm even if it’s generating some bad headlines. It’s also a good idea to speed up SIPC transfers and payouts even more, making it more like the FDIC, which encourages banks’ customers not to jump ship by working to transfer their money to a new bank the next business day, or even earlier, should anything go wrong.

We must also lower the probability that the failure of an investment bank or other lightly regulated financial institution would cause the dumping of tens or even hundreds of billions of dollars’ worth of assets simultaneously, eroding confidence in the value of similar assets. The government should thus create a permanent way in which big institutions or subsidiaries that aren’t FDIC-protected can collapse without endangering the economy: a conservatorship structure for failed or failing firms, similar to what the White House did with Fannie Mae and Freddie Mac in September.

The White House took over Fan and Fred in an orderly fashion, getting rid of existing management and letting shareholders suffer the losses. A conservatorship for future failed companies would have two key differences, though. In order to ensure that companies and their creditors wouldn’t have an incentive to take ever more risks, expecting future government bailouts, creditors would not be protected from their own losses. And while the government could provide financing to assure a failed institution’s continued operation for a while, the ultimate goal would be to close it down, selling good assets and paying back creditors and then shareholders with the proceeds, as bankruptcy courts already do. “It’s very important that creditors worry about the prospects” of a company, says Willem Buiter, a London School of Economics prof.

As Westbrook notes, such controlled failure would require a new legal category of bankruptcy that wouldn’t be simply a collection of private parties competing before a judge for their own interests. Instead, a government agency would represent the public’s interest in keeping the economy going. These extraordinary bankruptcies would prevent some creditors from taking their collateral immediately and selling it in a crisis. The change would mean that secured lenders to big investment firms would demand higher interest rates for the new risk that their collateral could be indefinitely frozen. But such a cost could be beneficial: it would make smaller, nimbler financial firms newly competitive against the lumbering giants likely to be affected by the new bankruptcy category. New York, for one, needs a few small investment firms to start rebuilding its key industry, and giving them an even playing field will help.

Lawmakers and the next president would have to decide whether the Fed or a new entity would be in charge of figuring out which companies fall into the new bankruptcy category. Size would matter, obviously; perhaps all financial institutions with more than $100 billion in assets would be included. But complexity would matter, too—including the extent of a firm’s dependence on short-term financing and the level of its involvement in labyrinthine securities markets. Above all, the government should make all the parameters explicitly public, so that these companies’ shareholders, creditors, and trading partners would understand in advance that they would face real losses in a crisis.

The next step is to ensure that markets have enough clear information to determine which companies are good and which are bad. Ever since FDR and Congress started requiring regular disclosure of pertinent financial facts as part of the New Deal, the feds and the companies they regulate have struggled to distinguish useful facts from useless information dump. In 1934, one letter writer grumbled to the New York Times that “there are two ways of deceiving the public—one is to tell them too little and the other is to tell them so much that they cannot separate the wheat from the chaff. It strikes me that Mr. Roosevelt’s Securities Act . . . is going to be primarily useful to the paper trade.”

We can always work to improve imperfect systems, though. In the next couple of years, the SEC will require firms to disclose data in a format simpler to read and search than the current one, and “tag” data, too, so that debt levels and profit margins are easier to compare across companies. A contemplated move to adopt less complicated global accounting standards, forsaking the domestic ones we’ve used for decades, could give companies an incentive to think of basic principles when disclosing facts and risks rather than labor to meet the requirements of thousands of pages of rules. The switch would also open up our books to more global investors.

Yet reports of the complexity of financial statements are exaggerated. Take Citigroup, a huge, complicated company. Citi’s annual report for 2005, issued before the credit crisis started, was 168 pages long, easy for a sophisticated investor to read in a couple of days. Even a just plain literate investor, armed with Google to look up a few terms, could slog through it. In the report, Citigroup disclosed some of the risks that have become only too apparent this year—admitting, for instance, that it could be on the hook for the performance of $55 billion in securities held “off balance sheet” (such obligations have become a major problem in the credit crunch).

But while you can lead an analyst to a financial report, you can’t make him read it or care. Investment banks like Bear Stearns were always very clear that their financial statements weren’t clear and that they were taking ever more risks in obscure areas of the markets. For years, analysts happily labeled such firms black boxes and gave up trying to understand them, just as analysts had done at Enron half a decade earlier.

Nevertheless, for every 100 people who invested blindly in the worst mortgage-backed securities two years back, one person read through a 500-page disclosure report on those securities and shorted them. Markets work through a combination of herd mentality, laziness, and real research, and the government can never change that reality. As William Douglas, the third commissioner in the SEC’s then-short life, said in 1937 of new disclosure rules: “We can demand full disclosure of the facts, we can insist upon a market free of manipulation, we can fight fraud, but we cannot provide sound business judgment, nor can we save a fool from his folly.”

As the government tries to decide where to shield the economy from human folly, a major criterion again should be size. If a new, custom-made kind of derivative security makes up a tiny percentage of the financial world, it likely doesn’t need much regulation because it can’t hurt anyone. But once it has grown into a market of tens of billions of dollars, it needs regulators and clear rules to protect it from a sudden loss in confidence that could injure the all-important money and credit supplies.

One problem with the current regulatory regime is having too many regulators with competing jurisdictions. In certain markets today, for example, it’s unclear whether regulatory responsibility lies with the Securities and Exchange Commission or the Commodities Futures Trading Association, and Congress has exempted some securities from any regulation. Consolidating different markets into one regulatory agency and beefing up staff and expertise would fill in some gaping holes.

As for which regulations to impose, that isn’t rocket science. Start with the boring old stock market. Until last year, the SEC forbade investors to “short” stock—that is, to borrow the stock and sell it in the hope of returning it to the lender once the price of the stock drops—unless that stock had first traded upward from its previous trade. That rule, implemented in 1937, made sense, because it kept short-sellers from pushing the value of a stock to zero. We should restore it.

In less straightforward financial markets, the government, and the remnants of the private industry, are already lighting a few candles. In what’s left of the credit-insurance market, for instance, financial institutions are slowly moving transactions into a central clearinghouse, rather than leaving them on thousands of investment firms’ and hedge funds’ books, so that instruments are more standardized and regulators can see what’s going on. In New York State, Attorney General Andrew Cuomo has recognized credit derivatives as insurance contracts and is preparing to regulate them as such. The same principle should hold across other markets and instruments. When something is large enough or threads its way through the investment world extensively enough to be able to cripple the entire system, it’s time to regulate it, by doing things like requiring a central, well-capitalized clearinghouse for transactions, limiting borrowing, and making sure that there is sufficient cash collateral to back up certain securities, as we already do in the stock market.

It’s also worth remembering that regulators are usually several steps behind the market. New regulations aren’t necessary now to rein in complicated structured-finance markets, for example; the markets have already declared them dead. And new regulations for the large investment banks have become irrelevant in the short term, because the last two survivors, Morgan Stanley and Goldman Sachs, have decided, under market pressure, to convert to commercial-bank structures, giving them permanent Fed lending privileges in exchange for greater oversight and borrowing restrictions. In the end, the market’s verdict works. The important thing is for regulation to lessen the risk that the market will destroy the economy to right itself.

Today’s markets are uncertain for economic and financial reasons, of course, but also because lenders can’t know what the future regulatory landscape will look like. It took Wall Street years to get used to the securities regulations of 1933 and 1934. True, it had to grow accustomed to regulation in the first place; today, firms are accustomed to answering to Washington in terms of securities disclosures and regulatory enforcement.

Any new regulations, even if enacted quickly and well, will likewise take time to get used to. So far, the presidential candidates have been vague on the big questions, when clarity could add confidence to the markets. Whatever the new president and the likely Democrat-controlled Congress decide to do, they need to be crystal-clear about it, as Roosevelt was 70 years ago. What’s left of Wall Street—and the entire economy—will need that head start to adjust to the coming changes.

Research for this article was supported by the Brunie Fund for New York Journalism.