In January, New York governor Andrew Cuomo announced a bold plan to bring a $4 billion casino and conference center to Queens. But the plan fell apart within months, thanks to the reluctance of the state’s prospective partner, the Malaysian gambling company Genting, to undertake the massive investment without a guarantee that it would have the exclusive right to operate casinos in New York City.

New York is one of several states that don’t want to be left behind as their neighbors institute more and more varieties of gambling. At least 12 states, facing downturn-depleted coffers, have already expanded gambling efforts over the last three years—including Massachusetts, which became the 16th state to sanction casinos. But this approach is utterly misguided, since gambling has often disappointed as a fiscal tool and as an economic-development strategy. As legal gambling has spread, competition for limited dollars has intensified, and the new gambling enterprises seem merely to be siphoning money from elsewhere in the economy instead of generating new economic activity. “This is not an industry that creates wealth,” says Les Bernal, head of the Stop Predatory Gambling Foundation. “It’s an industry that transfers wealth.” And that’s before taking into account the documented social costs, including the disturbing fact that a significant part of gambling revenues comes from problem gamblers.

Finally, a reason to check your email.

Sign up for our free newsletter today.

Gambling has been part of the American experience since the Founding. In the eighteenth and early nineteenth centuries, privately run lotteries, authorized by states, helped raise funds for everything from religious institutions to colleges. Harvard and Yale, for example, financed some new construction with lotteries. But as the practice grew more popular, fraud and other abuses increased, leading to a backlash. From the 1830s on, states began banning lotteries. The last state-sanctioned one ended in 1894, and the following year, Congress prohibited the interstate promotion of lotteries, making it tough to launch new ones.

For the next seven decades, gambling supporters proposed new lotteries, with little success. The landscape changed in 1963, however, after backers in New Hampshire began to promote a lottery as a way to increase school funding while keeping taxes low. The pitch worked, and voters approved a government-run sweepstakes. In 1964, its first year, New Hampshire sold $5.7 million in lottery tickets.

A majority of New Hampshire’s ticket buyers, it turned out, were from surrounding states. That discovery spawned a wave of similar lottery bills along the East Coast—starting with New York and New Jersey in the late sixties—as other governments hurried to grab a piece of the action. As in New Hampshire, the lotteries were promoted as a way to keep taxes down while financing worthy causes, from education to services for senior citizens. By the close of the seventies, nine states had lotteries; by 1989, another 20 states had added them; today, 43 states have lotteries, most of them run by the states themselves. Collectively, the lotteries net about $18 billion a year for the states.

A second form of gambling, casinos, began to spread in the late seventies, pitched as both a budget fix and as an economic-development tool. Atlantic City was the first to go this route. Once, illegal gambling parlors had thrived there; then the U.S. Army, which billeted thousands of troops in the city during World War II, put a stop to them, and the once-popular resort began a precipitous decline. In 1974, backers got a referendum on the state ballot to legalize gambling in Atlantic City, claiming that it would revitalize the area, but voters, seeing no benefit for the state as a whole, shot it down. It wasn’t until 1976 that a referendum successfully legalized gambling—this time because supporters claimed that it would generate 21,000 jobs within five years. The argument did little to sway religious leaders or the editorial boards of prominent New Jersey papers, but it did convince enough voters so that the casinos got approved. In the Jersey model, private companies owned and operated the casinos, but the state controlled them tightly, dictating everything from operating hours to the kinds of games allowed.

At the close of the eighties, the casino craze really took off. At first, states on or near the Mississippi River—Iowa, Illinois, Indiana, Louisiana, Mississippi—licensed riverboat casinos, thinking that they would boost the sagging fortunes of older cities without creating unattractive gambling strips on land. But eventually, land-based casinos proliferated as well. At the moment, 15 states license casinos, the taxes and fees on which bring in about $4.5 billion in annual government revenue, according to the Rockefeller Institute. Twelve states permit racetracks to install gambling devices, such as slot machines and video lottery terminals, sending governments another $2.9 billion a year. Finally, Native American tribes, authorized by Congress, operate casinos in 28 states. Though states don’t have the power to regulate these casinos, some have revenue-sharing deals with the tribes, which generate about $1.4 billion in annual revenue, the Rockefeller Institute estimates.

In short, states have steadily dropped prohibitions on gambling ever since New Hampshire’s 1964 lottery. Today, every state but two (Hawaii and Utah) counts on revenues from some kind of legal betting. Taken together, all forms of legal gambling, including horse racing, bring in around $24 billion yearly for states and municipalities. That might sound like a substantial sum, but it constitutes only about 1 percent of combined state and local revenue. Property taxes, by contrast, account for $433 billion annually in state and local funds, and income taxes account for another $270 billion.

Gambling hasn’t lived up to its promise of closing budget gaps. Stateline, a service of the Pew Center on the States, examined ten states that had legalized or expanded gambling over the past decade and found that, in most cases, revenue fell well short of initial projections, despite the usual claim that gambling is recession-proof. Oklahoma officials, for example, predicted that their lottery, launched in 2005, would raise $150 million in yearly revenue; five years later, the take was only $70 million. Also in 2005, Maine approved “racinos,” racetracks with electronic gambling machines, predicting that they would shower the state with $32 million a year; they have yet to hit that number. More recently, Arkansas claimed that its new lottery would generate $100 million annually for state-sponsored college scholarships; the take last year was $89 million.

The shortfalls are greater in the states that adopted gambling earlier, since those states have lost their lucrative monopolies. Take the New Jersey government, whose haul from Atlantic City casinos peaked at $477 million in 2006, the year before the first casino opened in neighboring Pennsylvania, and shrank to $327 million in 2010. Other places face similar threats if their neighbors get into the game. A study commissioned by the Louisiana Gaming Control Board, for instance, warned that gambling’s benefits to the state outweighed its costs largely because Texans crossed the border to gamble. If Texas were to legalize casinos, the study concluded, Louisiana’s industry would suffer.

The legalization of new forms of gambling has helped destroy older ones. Pari-mutuel betting at state-sanctioned racetracks, once the most common form of gambling, now raises just $150 million in annual state revenue. In New Jersey, casinos have killed it off. When Jersey first legalized casino gambling, racetracks were home to 80 percent of legal betting in the state; today, they account for only 2 percent. Average daily attendance at the state’s Meadowlands Racetrack—the revenues from which helped build Giants Stadium, since demolished—is down to 2,800, from 16,500 in the mid-seventies. The New Jersey Sports and Exposition Authority, which built and ran the track, is insolvent.

Over the long term, gambling revenue has failed to hold down taxes, despite supporters’ predictions. New Jersey was the first state to legalize both casinos and the lottery. When its first casino opened in 1978, the state was the fifth most heavily taxed in America, according to the Tax Foundation. Now, despite garnering more revenue from gambling than all but four states, its tax burden is the nation’s second heaviest. New York, which brings in the most money from gambling, is also the nation’s most heavily taxed state. Louisiana’s state lottery started in 1991, followed in 1993 by privately owned video poker and casinos. Since 1994, the state’s average per-capita tax burden has increased from $2,080 (in today’s dollars) to more than $3,000. “Initially, when gambling came in, it was highly misrepresented at the time as an answer to all our fiscal problems. History has simply proven that not to be true,” Louisiana state senator A. G. Crowe told the press in 2008.

Why haven’t gambling revenues provided budget relief? One reason is that they sometimes get captured by the same special interests that co-opt tax dollars. California instituted a lottery in 1985 to boost education funding, promising to use the revenue for classroom supplies and programs. But as the Orange County Register reported in 1988, nearly $6 out of every $10 in lottery revenue sent to the schools was used to boost teacher salaries instead.

Another reason that gambling has failed to close states’ deficits is that it doesn’t capture money for the government that otherwise would be spent on untaxed illegal betting, as supporters claim. A 2002 National Bureau of Economic Research study of 21 states by economist Melissa Schettini Kearney found that, in the first year after a state instituted a lottery, consumer spending on other purchases fell by about $42 per month per household—nearly as much as was being wagered on the new lotteries. After California’s lottery was introduced, the state’s grocers’ association reported a 7 percent decline in sales. One northern California retailer, Holiday Quality Foods, announced that it would stop selling lottery tickets because its profits had fallen 10 percent after starting to offer them.

Gambling’s record as an economic-development tool is no better. Supporters often point to the number of people that local casinos or betting parlors employ. But they don’t take into account the employment lost in other industries because of the introduction of gambling. The National Gambling Impact Study Commission, created by Congress, noted in a 1999 report that hundreds of restaurants and bars closed in the greater Atlantic City area after casinos began opening, offsetting some of the employment gains. The commission added that when it visited the city in 1998, it found unemployment substantially above the average for the nation and for much of New Jersey.

That situation hasn’t greatly improved with time. A special commission created by Governor Chris Christie noted in a 2010 report that, after nearly 35 years of legal gambling, Atlantic City suffered from the public perception that it was “unclean and unsafe” and had never been able to give rise to a meetings-and-conventions business. Casinos, the report noted, had failed to spawn “non-gaming amenities” that might attract visitors interested in anything other than gambling. The numbers underscore the lack of progress. Median family income in Atlantic City in 1980, according to the census, was $34,800 in 2010 dollars. In 2010, it was $35,500.

Indiana legalized gambling in 1993, and several years later, casinos opened in the impoverished city of Gary. The city’s mayor testified before members of the National Gambling Impact Study Commission that revenues from gambling were helping revive the city. Over the long term, though, casinos brought no appreciable benefit to Gary’s economy. In 1990, the census shows, family income in Gary was $38,158 in today’s dollars; it now averages $33,158—about 13 percent lower than before the casinos arrived. The city’s poverty rate remains unchanged. Atlantic City and Gary don’t seem unusual in this respect. As part of the congressional commission’s 1999 study, the National Opinion Research Center surveyed communities with legal gambling. It concluded that gambling produced no boost “in overall per capita income,” as increases in certain industries were offset by declines in others.

No effort to assess the impact of legal gambling can ignore its social costs. The Tax Foundation argues that state lotteries represent one of the steepest of all taxes, since the government keeps an average of 42 percent of betting proceeds—far higher than the sales-tax rate that states would charge if the wagered money were spent on something else. The lottery tax is also hidden, since few people recognize it as a government levy. And the burden of this hidden tax is not equally distributed. Numerous studies have shown that lotteries tend to attract lower-income, less educated players, cutting significantly into personal income and private-sector spending in poorer neighborhoods. One recent study found that households with less than $12,000 per year in annual income spend 5 percent of it on the lottery. In part, lower-income households spend so much because they buy the aggressive advertising of state lotteries, which claims that participating in them will bring you riches. A poll several years ago found that 38 percent of those earning less than $25,000 annually considered buying lottery tickets a good retirement strategy.

Another social cost is crime, which appears to rise after casinos open. The most comprehensive study of crime and legal gambling, conducted by economists Earl Grinols and David Mustard and published in The Review of Economic Statistics in 2006, examined 167 counties where casinos had opened over the 20-year period ending in 1996. In those counties, the authors estimated, 5.5 percent to 30 percent of serious crimes in six categories were attributable to gambling. The casino counties suffered 157 more aggravated assaults per 100,000 residents than non-casino counties did, for example. Of the seven kinds of crime studied, only one, murder, didn’t spike. Making the point that social costs are economic costs as well, the study estimated that by 1996, the extra crime was costing the casino communities $1.8 billion (in today’s dollars) per year.

Some of the increase in lawbreaking can be attributed to problem gamblers who grow desperate and turn to crime to pay for their addiction. The National Research Council estimated in the 1999 congressional gambling study that 1.5 percent of adults were “pathological” gamblers and that another 3.9 percent were “problem” gamblers. (The difference lies in how many of the ten criteria for problem gambling someone displays.) The commission also referred to Harvard Medical School research concluding that as many as 7.9 million adolescents were potentially pathological or problem gamblers.

Perhaps the most unsettling statistic associated with legal gambling—obscured by media clichés about how “nearly everyone” gambles occasionally in America—is the inordinately large share of gambling revenue that comes from problem gamblers. A 1998 study commissioned by Montana’s state gambling commission estimated that problem gamblers accounted for 36 percent of revenue from electronic gambling devices and 18 percent of lottery scratch-ticket sales. A 1999 study by the Louisiana Gaming Control Board determined that problem gamblers accounted for 30 percent of spending on riverboat casinos, 42 percent of spending at Indian casinos, and 27 percent of betting on video lottery terminals and other electronic games. A 2004 report in Ontario, Canada, found that problem gamblers, though constituting about 4.8 percent of the province’s population, produced 35 percent of its gambling revenue from lotteries, sports betting, bingo, gambling machines, and casinos. The report’s authors pointed out that their findings contributed to “converging lines of evidence indicating that a substantial portion of gaming revenue derives from people who are negatively impacted by their involvement in this activity.”

These troubled people can devastate their lives and those of their families through the intensity of their gambling. A National Opinion Research Center survey noted that nearly 20 percent of self-reported pathological gamblers and 11 percent of problem gamblers had filed for bankruptcy at some point in their lives, compared with less than 5 percent of non-gamblers. Pathological gamblers were also three times more likely than non-gamblers to have collected unemployment compensation during the previous year. Some 21 percent of pathological gamblers and 10 percent of problem gamblers had been behind bars, the study found, compared with less than one-half of 1 percent of non-gamblers. Divorce and homelessness rates were also far higher for gamblers.

Despite such evidence, politicians desperate for revenue and lottery officials under pressure to deliver it have promoted new games that increase addiction levels. As participation in the traditional weekly drawing has declined, many state lotteries have added “instant” games in which players discover immediately whether they have won or lost. Gambling-addiction circles call these games “gateway drugs” because they’re often the first exposure to gambling for young people, who play them disproportionately. A National Opinion Research Center study reported that 75 percent of adolescents who gambled favored instant games. In Texas—where one state senator, Eliot Shapleigh, calls them the “crack cocaine” of lotteries—an alarming 75 cents of every dollar spent on the lottery goes to instant games. Including Texas, 42 states now offer them.

Even instant games aren’t as addictive as the favorite gambling instruments of legal-betting proponents: video slot and poker machines. Around the country, states have introduced these devices at “slot-only” or “convenience” casinos, sometimes at failing racetracks. The machines’ sophisticated technology makes losing feel like winning by feeding players near-winning combinations. This triggers the release of dopamine, the body’s feel-good chemical, in the players’ brains, encouraging them to keep playing—and losing. So addictive are these machines, according to Kevin Horrigan, a video-game designer and computer-science expert at the University of Waterloo in Ontario, that two-thirds of those seeking help for gambling addictions in the province report that their principal gambling activity is using video slots. One Wisconsin lawyer, jailed for gambling away $2.5 million of a client’s money on slot machines, described them at his 2010 sentencing as “the greatest drug there ever was.”

The rapid spread of video slot machines has already resulted in at least one staggering social meltdown. From the early 1990s through the end of the decade, after a series of court rulings interpreted a state law that permitted payoffs on pinball machines to include video slot machines, the devices proliferated in South Carolina. By 1996, more than 18,000 machines were in operation around the state, and three years later, the number had doubled, collecting $3.3 billion a year in bets. The social effects were hard to miss, even for those who had initially backed gambling. One study found that the fraction of problem gamblers in the state’s population had increased from 2 percent to 12 percent. Just two years after the final court ruling, bankruptcies had risen 33 percent, and financial fraud, including the passing of bad checks, had jumped by nearly half. Horrifying stories made headlines, including one of a mother who left her ten-month-old baby in her sweltering car, windows closed, while she played video poker at a roadside casino for seven hours; the baby died of dehydration. Revulsion over such stories eventually helped create a broad coalition, ranging from churches to the state’s chamber of commerce, opposing the terminals. In 1999, the state banned them, ending what the Charlotte Observer called a “long messy experiment” with video betting.

Faced with these facts, supporters argue that consumers already have legal access to cigarettes and alcohol, which can be addictive and lead to destructive behavior, so it makes no sense to treat gambling differently. Yet there’s no evidence that alcoholics’ share of alcohol sales is anywhere near problem gamblers’ enormous share of gambling sales.

Meantime, in a landmark case brought by 46 state attorneys general, cigarette companies accused of having minimized the addictive nature of smoking agreed to pay states $206 billion over 25 years. The companies also agreed to widespread restrictions on the marketing of tobacco products and joined states in disseminating information on the addictiveness of smoking. By contrast, the entities that spend hundreds of millions of dollars every year promoting lottery tickets are our state governments themselves. Much of the advertising has been deemed misleading, including by the National Gambling Impact Study Commission. The Federal Communications Commission can’t regulate state lottery advertising, so states don’t have to include in their ads information on the odds of winning (unlike commercial sweepstakes, which do). Lottery ads often focus on the sum of the payments that a winner would receive, which would be made over 20 years, but neglect to mention that the immediate value of the jackpot is far less—even smaller after taxes. State lotteries have long employed a variety of dubious slogans and pitches, ranging from “All you need is a dollar and a dream” to “Work is nothing but heart-attack-inducing drudgery.”

Notwithstanding the widespread failure of gambling as a fiscal and economic-development tool, states keep trying to use it. New York is exploring full-fledged casinos, while in response, New Jersey politicians are urging the governor to expand casino gambling statewide—though that would likely cannibalize revenue from Atlantic City. Massachusetts’s recent vote to approve casinos has prompted politicians in other New England states, such as Rhode Island, to push for their own. And as consumers’ interest in traditional lotteries continues to wane, states scramble to add more games, even eyeing sports betting—which today exists legally only in Las Vegas.

So politicians, too, are addicted to gambling. Their addiction will damage many lives—and fail to help state finances.

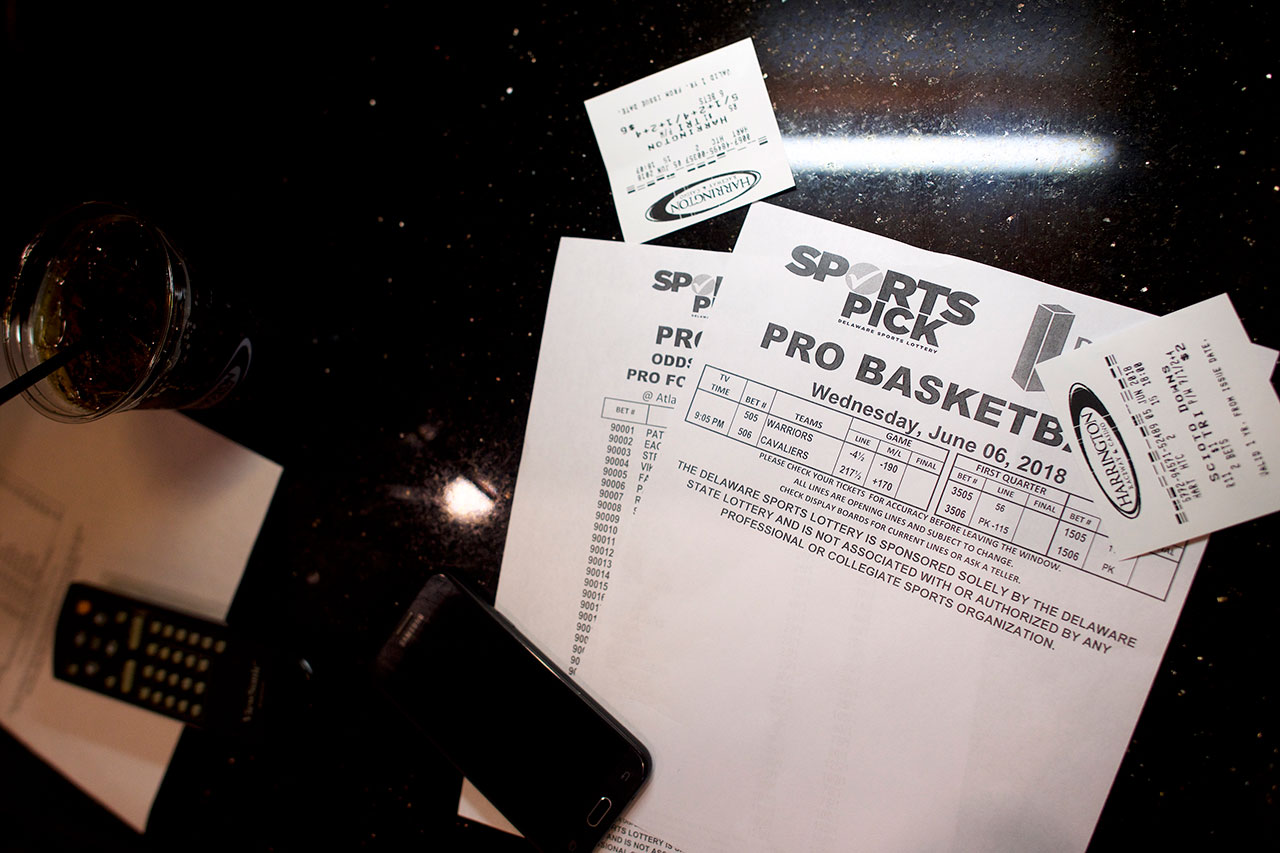

Top photo by Mark Makela/Getty Images