Like the rest of America, New York City has been buffeted by the recession that began in December 2007. This past August, the city’s unemployment rate stood at 9.6 percent, just over the national rate of 9.5. But New York’s economy will never recover from the downturn by trying to compete with China’s labor costs or with Houston’s housing costs. Nor can the city continue to rely on finance, which came to dominate it over the last 40 years: as the sad history of Detroit illustrates, one-industry towns rarely succeed in the long run. Rather, New York’s success will depend on its ability to produce a steady stream of new products and ideas.

Indeed, studies have shown that all over the country, entrepreneurship—along with January temperature and education—is one of the three great predictors of urban success. But nowhere is that more the case than in Gotham, whose very history is a tale of entrepreneurship. To survive, New York must continue to bring forth innovators who will reinvent the city—with luck, making it more economically diverse. If they succeed, it will change as much between 2010 and 2050 as it did between 1970 and today.

Finally, a reason to check your email.

Sign up for our free newsletter today.

Entrepreneurs have played a key role in every stage of New York’s development. During the early nineteenth century, when waterways were the lifelines of commerce, New York owed its expanding sea trade partly to natural advantages: a safe, centrally located harbor and a deep river that cut far into the American hinterland. But those advantages became important because of the vision and energy of entrepreneurs like Jeremiah Thompson, the gambling Quaker. Thompson immigrated to New York at 17 to work in the American branch of his family’s wool business. By the 1820s, he had established himself as America’s largest importer of English clothing, its largest exporter of raw cotton, and its third-largest issuer of bills of exchange.

As a global trader, Thompson was acutely aware of the shortcomings of the transatlantic ships of the time, which would stay in port until their hulls were filled with goods. (Imagine showing up at LaGuardia and having to sit around until the airline sold enough tickets to fill the entire flight to Frankfurt.) Thompson saw an opening and created the Black Ball packet line, whose ships set sail on a scheduled day every month, no matter how light their cargoes were. His innovation was a gamble, since sometimes his ships sailed with relatively empty hulls, which meant less income from the merchants who bought the space. But a virtuous circle developed: fixed schedules attracted more cargo, and more cargo made ships sailing on fixed schedules more profitable. Once Thompson was turning a profit, other packet lines, like the Yellow Ball and Swallowtail lines, entered the market. An 1827 letter to the New England Palladium described the significance of Thompson’s invention: “I consider Commerce by lines of ships, on fixed days, an invention of the age nearly as important as Steam Navigation and in its results as beneficial to New York, which has chiefly adopted it, as the Grand [Erie] Canal.”

Thanks to such innovation, the city grew great during the first half of the nineteenth century, its population rising from 33,000 in 1790 to 814,000 on the eve of the Civil War. In 1821, New York’s exports, measured in dollars, were less than 10 percent higher than Boston’s. By 1860, New York was exporting over 700 percent more than the city on the Charles.

The surging harbor traffic was important to the city not only directly but also because of the business that sprang up around the port. New York’s three largest nineteenth-century industries—sugar refining, apparel manufacturing, and printing—all benefited from the ships coming into the harbor. Again, the rise of these industries did reflect the city’s innate advantages. Sugar refining thrived, for example, because New York was the natural hub of the triangular trade that connected the northern colonies with European manufacturers and markets and with southern sugar, tobacco, and cotton farmers. Since so much sugar was already flowing into New York’s harbor, it made sense to refine sugar nearby. By 1860, 18 of America’s 39 sugar refineries were in New York.

But New York wouldn’t have become America’s sugar capital without risk-taking entrepreneurs. In the mid-eighteenth century, Isaac Roosevelt, Franklin Delano’s great-great-grandfather, started refining sugar near Wall Street. He was taking a substantial risk—sugar refineries were big factories for their time—but his investment paid off. Roosevelt later became president of the Bank of New York and a New York state assemblyman. Some suggest that the Roosevelt interest in politics began because Isaac didn’t like British sugar policies.

Roosevelt’s success foreshadowed the even more remarkable path of German immigrant William Havemeyer. Havemeyer learned the sugar trade in London and came to New York in 1799 to manage a sugar house on Pine Street, carrying a bill of exchange drawn on Isaac Roosevelt’s sugar-refining son. Havemeyer eventually broke away to form his own enormously successful firm, which his descendants would rename Domino Sugar.

As sugar refining increased in scale, it stopped being an entry point for entrepreneurs (just as the automobile industry, once a great cluster of innovators, eventually became a model of economic sterility). Luckily, New York’s port attracted the apparel business, which became the city’s largest industry for over a century, employing hundreds of thousands of workers, many of them immigrants. It also allowed thousands of small-scale entrepreneurs to get started, sewing blouses at home or selling door-to-door. After World War II, in fact, the garment industry was the biggest industrial cluster in the country, employing far more workers than Detroit’s automobile producers did.

A. E. Lefcourt was one of the many early-twentieth-century entrepreneurs who emerged from the garment trade. Lefcourt was born poor and started work as a teenage newsboy and bootblack. Even after he got a job in the garment industry, he continued selling papers in the morning and shining shoes in the evening, saving enough to buy a $1,000 Treasury bond, which he kept pinned to his shirt. When Lefcourt was 25, his employer decided to retire. Lefcourt borrowed to the hilt to buy the firm and built it up over the next decade, to the point where it was doing $2 million a year in sales (more than $40 million in current currency). He also played a major part in ending the “Great Revolt” of 1910, in which 60,000 garment workers went on strike. Lefcourt, still in his early thirties, led the management side of the battle and helped negotiate the so-called Protocol of Peace.

That summer, at the same time that he was bargaining with the labor unions, Lefcourt began a new career as a real-estate developer. He sank all his capital into a 12-story loft building on West 25th Street that would house his own firm. He then built more and helped move the apparel industry from the old sweatshops into the modern Garment District. Soon he branched out into other kinds of structures, erecting 31 edifices, many of them skyscrapers, over the next 20 years. The Wall Street Journal wrote that he “demolished more historical structures in New York City than any other man dared to contemplate.”

By 1928, Lefcourt’s real-estate wealth was estimated at $100 million, making him a billionaire in today’s dollars. He celebrated by opening a national bank bearing his own name. Unfazed by the stock-market crash, Lefcourt planned $50 million of construction for 1930, sure that it would be a “great building year.” Overoptimism seems almost a necessary ingredient in entrepreneurship, and this time Lefcourt was wrong. He died in 1932 with an estate worth only $2,500 but with a phenomenal physical legacy, including the Lefcourt Colonial Building, the Essex House (now the Jumeirah Essex House), and his most famous structure, the Brill Building, whose name came to stand for an entire musical style.

Fifty years ago, the economist Benjamin Chinitz used the apparel industry to compare New York City, which then seemed like a model of small-scale entrepreneurship, with Pittsburgh, a city of massive steel companies. “My feeling is that you do not breed as many entrepreneurs per capita in families allied with steel as you do in families allied with apparel,” Chinitz wrote. “The son of a salaried executive is less likely to be sensitive to opportunities wholly unrelated to his father’s field than the son of an independent entrepreneur.” Few economists would use the word “breed” today, but Chinitz’s hypothesis remains legitimate: a vast industry of small-scale entrepreneurs leads to the development of entrepreneurial skills, which are used in other industries and also passed along to children.

In the 1960s, the garment industry—that great incubator of entrepreneurship—left New York. Between 1968 and 1975, the city lost 400,000 manufacturing jobs. Steady improvements in transportation technology had made the advantages associated with ports and rail yards obsolete. Why sew on 28th Street when you could do it more cheaply in a right-to-work state or in China? Social distress and political mismanagement only compounded the city’s problems. New York, like all of America’s older, colder places, seemed headed for perpetual decline.

But entrepreneurship saved the city once again, this time in the financial sector. Wall Street had been relatively quiescent for 25 years after the 1929 crash: the Depression had dampened the public’s taste for risk, and a growing web of regulation restricted innovation in the securities industry, for good and for ill. The securities industry was also facing the threat of an antitrust case that was dismissed only in 1954—the same year that the Dow Jones Industrial Average finally passed its precrash peak. During the 1950s, Wall Street did experience a bull market, but finance was still dominated by blue-chip firms like Morgan Stanley, hardly a model of entrepreneurship. Regulations, along with fear, kept banking conservative.

Gradually, in the 1960s, at least three distinct trends—the rise of mathematical finance, the democratization and globalization of investment, and the breakdown of old social barriers—made finance in New York considerably more entrepreneurial. A more sophisticated approach to risk and return began with academics in the 1940s and eventually arrived on Wall Street in the form of tools that could price new assets, like options, and assess whether older investments were priced appropriately. This more sophisticated approach to risk and return enabled the young Michael Milken to argue that junk bonds looked cheap, relative to their historical risk. His breakthrough made it easier for other financial entrepreneurs, like Henry Kravis, to finance acquisitions. It may seem, after the recent crash, that the quantitative approach to finance was a mistake; but the mistake was not using the tools but overusing them and putting far too much faith in them.

Kravis also benefited from ever-more-connected capital markets, which let him access capital from far-flung investors, like pension funds in Oregon. Other entrepreneurs, like Charles Merrill, worked to increase the number of people who invested in Wall Street. The number of Americans who owned securities rose from 12.5 million in 1960 to 32 million in 1972.

This swelling sea of funding helped erode the old social barriers that had once bound Wall Street. Back when New York was smaller and more closed, a small set of connected financiers had lent only to people whom they knew personally. J. P. Morgan himself told Congress in 1912 that character was everything: “A man I do not trust could not get money from me on all the bonds in Christendom.” By all accounts, Morgan’s ghost still roamed the halls when his grandson ran Morgan Stanley in the 1950s. But by the 1970s, New York was full of outsiders finding financing regardless of their backgrounds.

In fact, the great mergers-and-acquisitions wave that began in the 1970s was led by entrepreneurial outsiders who were figuring out how to get value by borrowing vast sums and taking over sleepy, underperforming firms. Carl Icahn, T. Boone Pickens, Saul Steinberg, Irv “the Liquidator” Jacobs, and many others had never been part of the Wall Street establishment, but their acquisitions made plenty of money for Wall Street. Lewis Ranieri worked his way up from the mailroom at Salomon Brothers to lead the mortgage-backed securities market that moved trillions of dollars of housing-related assets from banks’ balance sheets to investors throughout the world. In the wake of the crash, again, one can reasonably debate the value of these financial innovations, but for New York, the jobs, earnings, and philanthropy that they produced were long a source of civic strength.

New York isn’t unusual in depending on its entrepreneurs. All over the country, urban growth depends upon urban entrepreneurship—though measuring that entrepreneurship is easier said than done. There are at least three plausible, widely available statistical measures of entrepreneurial activity: average firm size, the entry rate of new unaffiliated establishments, and the self-employment rate. Average firm size distinguishes between places like Detroit, dominated by a few large employers, and places like Brooklyn, with an abundance of smaller, nimbler firms. The smaller a city’s average firm, the thinking goes, the more entrepreneurial the city. The entry rate of new unaffiliated establishments, probably the most direct measure of entrepreneurial activity, refers to the percentage of employees in a metropolitan area who are working in new firms that don’t share ownership with preexisting ones. As for the self-employment rate, it is a considerably less popular measure among economists, since it doesn’t capture many important forms of entrepreneurship—hedge-fund managers, for example, rarely work for themselves—and is swamped by very modest entrepreneurs.

None of the three measures is a perfect barometer of that hard-to-define quantity that we call entrepreneurship. But the good news is that all three usually move together. That is, places with smaller firms tend to have a high entry rate of new unaffiliated establishments, and they also tend to have high self-employment rates. The three measures suggest that levels of entrepreneurship differ substantially across regions of the country. For example, according to the 2000 census, average company size in counties with more than 200,000 people ranged from fewer than ten people (in Pasco County, Florida) to almost 30 (in Suffolk County, Massachusetts, which includes Boston).

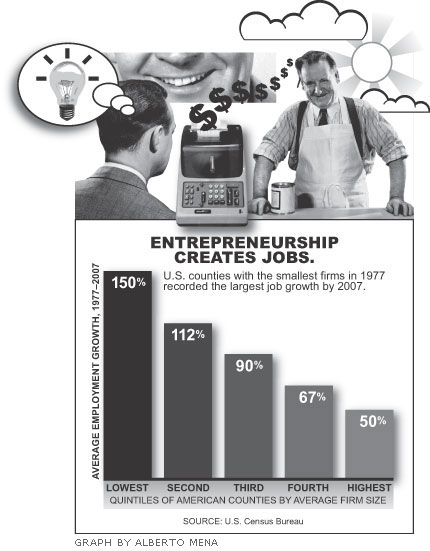

What’s more interesting—in fact, remarkable—is how well these measures of entrepreneurship predict the subsequent success of metropolitan areas. Between 1977 and 2007, the American counties with the smallest firms enjoyed employment growth of 150 percent; employment growth in the counties with the biggest firms was one-third of that (see the chart below). Similarly, as an area’s share of employment in recently formed companies rose, employment growth rose as well. In both cases, the impact on payroll growth was almost the same as the impact on employment growth. Entrepreneurial cities are successful cities.

An obvious objection to that claim is that perhaps it shows merely correlation, not causation. That is, perhaps certain areas have attributes—the weather, the regulatory climate, and so on—that both attract entrepreneurs and engender growth, which could explain why the two occur together. While it’s impossible to reject that hypothesis completely, several pieces of evidence argue against it. For one thing, even after controlling for a wide range of local characteristics, the correlation between the entrepreneurship measures and subsequent growth remains strong. For another, the relationship between entrepreneurship and growth works even within cities. Together with William Kerr and Giacomo Ponzetto, I’ve studied sectors within cities and shown that those with smaller firms (or more start-ups) tend to have faster employment growth—and that wouldn’t be the case if the connection between entrepreneurship and growth merely reflected, say, the weather.

With this knowledge about entrepreneurship in mind, we can start to understand some of the perils that New York faces today. The enormous expansion of finance allowed Gotham to recover from its 1970s crisis, but it also made the city heavily dependent on a single industry. By 2008, more than 40 percent of Manhattan’s payroll came from finance. Not only has this industry come to dominate the island; it is itself dominated by relatively big firms. Portfolio management, hedge funds, and mutual funds are the most entrepreneurial parts of the sector, at least as measured by average firm size, but they employ only 12 percent of financial workers in Manhattan. Far more are found in commercial banking (average firm size, 67) and securities brokerage (58). All in all, the average financial-services establishment in Manhattan has 39 employees, about three times the national average.

These firms may not be General Motors–size, but they are awfully big. Thanks partly to them, the average size of a Manhattan company is 19.7 people—higher than 87 percent of counties with more than 200,000 residents. And the track record of cities dominated by single industries and big firms—think Detroit—is not good. Further, New York’s financial sector owes part of its continuing strength to the extraordinary federal interventions that saved so many big banks. That isn’t comforting, either, since heavily subsidized sectors often become heavily regulated sectors where innovation doesn’t happen.

Note, too, that New York’s hold on its financial entrepreneurs seems weaker than in the past. Over the past 30 years, the most successful financial entrepreneurs have been managers of hedge funds, which are attractive because they are relatively free of regulatory supervision and because compensation is treated as capital gains rather than income. But whereas hedge-fund entrepreneurs in the seventies and eighties typically started out as traders or analysts at larger firms, today they begin by working at other hedge funds—many of them located in Fairfield County, Connecticut, to avoid New York taxes. That means that tomorrow’s financial innovators are likely to be located outside New York. True, as of 2007, the portfolio-management sector (which includes hedge funds) was still more than four times larger in Manhattan than in Fairfield County. Yet the Fairfield financiers earn more and work in smaller firms, with an average of 17 employees (as opposed to 23 in Manhattan), meaning that there may be greater dynamism in the suburbs.

Even the career of New York’s mayor suggests that the city would benefit by being less finance-focused in years to come. Michael Bloomberg worked with Lewis Ranieri at Salomon before breaking away to start a firm that manufactured data terminals for traders. As his success illustrates, some of the most important forms of entrepreneurship occur when knowledge from one industry (in this case, Bloomberg’s understanding of traders’ data needs) makes its way to another (the production of data terminals). For such intellectual cross-fertilization to take place, a city must have many different industries, not a single behemoth.

On a more positive note, Manhattan is one of the unusual places where the three measures of entrepreneurship don’t move in sync. Though its companies, again, are large, its self-employment rate is 9.5 percent—quite high, compared with the national rate of 6.5 percent. Also, in the mid-1990s, the New York area ranked third in the Northeast in the share of its workers laboring in start-ups. (We don’t have that statistic for more recent years.) And even the size of an average firm varies by location within New York City: in Brooklyn, it’s just 10.9 people, suggesting that entrepreneurship may be shifting to the less expensive outer boroughs. So even in a city increasingly dominated by the big firms of a single sector, there may be plenty of entrepreneurship left.

Can public policy encourage entrepreneurship? In New York, the primary agency for doing so is the New York City Economic Development Corporation (NYCEDC), which can issue tax-exempt bonds to pay for development and industrial projects. It can also offer firms tax exemptions and loans, and it oversees a great deal of public space where companies may wish to locate.

Since Adam Smith, however, economists have been skeptical about the government’s ability to micromanage business growth. Twenty years ago, in the flush of Japanese economic expansion, America saw a vogue for Japanese industrial policy, which consisted of aggressively supporting particular firms through a Ministry of International Trade and Industry (MITI). But when researchers actually examined MITI, they found that it picked losers: the firms that the ministry backed did worse than the ones that proceeded on their own. That MITI was staffed with the best and brightest of Japan stands as a warning to any government that wants to play venture capitalist. Many have concluded that the wiser course for government is to develop a good environment for business, not to play favorites.

While I generally concur with this conclusion, an entity like the NYCEDC is nevertheless valuable. Its existence helps signal that New York cares about economic development. Since so many public agencies care about other things, it is surely good to have at least one public entity focused on the needs of business. Plus, it would seem foolish to throw away the ability to raise money for economic development with tax-exempt bonds. The world might well be a better place if no city gave out firm-specific deals to attract big companies, but so long as Atlanta, Chicago, and Dallas are bidding on businesses, it’s hard to argue that New York should take the high road. Important new research by MIT’s Michael Greenstone and Berkeley’s Enrico Moretti suggests that areas that win bidding contests for million-dollar plants receive substantial benefits. Finally, New York City owns a lot of property, and someone needs to manage it.

But the NYCEDC’s ability to foster entrepreneurship will always be limited. Important entrepreneurship is unpredictable and hard to create from the top. Tax exemptions work best with large plants, not small, hard-to-evaluate new firms. Indeed, one worry about providing public support for large employers is that they crowd out the smaller ones that are more likely to be long-term engines of growth. For smaller firms—the real entrepreneurs—a city’s overall business climate is more likely to matter than any particular economic-development policy.

And in New York, anyone trying to make the business climate friendlier—freer of taxes and regulations—confronts a Herculean labor. New York City imposes an income tax on its earners and a corporate tax on its businesses (on top of state taxes). Property taxes are also high. There is no easy answer to this problem. New York City’s infrastructure will always be expensive; the taxes needed to finance it will always make the city less attractive to many firms. (The silver lining is that many entrepreneurs earn little during early stages, making them relatively immune to most income-related taxes.)

But regulations, another substantial deterrent to entrepreneurship, may be easier to fix. New York City has a long history of overregulating small businesses (see “Small Businesses to NYC: Get Off Our Backs!,” Autumn 2009), and though regulatory environments are typically evaluated at the level of states, not cities, most evaluations suggest that New York State is a particularly bad place to do business. When CNBC graded states “on the perceived ‘friendliness’ of their legal and regulatory frameworks to business,” New York came in 42nd. Chief Executive polled CEOs about the best and worst states for taxation and regulation, and New York State got a D-minus, worse than any state except California and Massachusetts. The Pacific Research Institute ranked New York 50th on its economic-freedom index, as did George Mason University’s Mercatus Center. The one outlier is Forbes, which put New York in the middle of the pack in its rankings of best states for business—but when the magazine ranked large metropolitan areas, it put New York City dead last.

If Gotham wants to attract entrepreneurs, changing its stifling regulatory climate—particularly rules that make it difficult to open new businesses—would be a good place to start. Zoning rules, sharply limiting the activities that can be pursued in different parts of the city, also hinder entrepreneurship by driving up real-estate prices, and hence the cost of doing business, in those parts where entrepreneurial activities are allowed. Manhattan’s barriers to building, long among the country’s highest, are another reason for its astronomical rents. Lowering these barriers—for example, shrinking the largest historical-preservation districts—would lower real-estate costs and help the city become more entrepreneurial (see “Preservation Follies,” Spring 2010).

Fifty years ago, Jane Jacobs correctly pointed out that “only operations that are well established, high-turnover, standardized or heavily subsidized” could afford expensive real estate but incorrectly argued that preserving old buildings would encourage the entrepreneurs who needed cheap space to rent. The truth is that restricting urban change makes space more, not less, expensive, limiting the space that could make the city both more affordable and more entrepreneurial. The way to keep prices down is to build more.

Since important innovation is inherently unpredictable, the best economic-development policy may be to attract entrepreneurial people and get out of their way. But what attracts entrepreneurial people? Jed Kolko, Albert Saiz, and I have created an “amenity index” for American metropolitan areas by comparing property values with income levels. The idea is that places that are expensive, relative to their wages, must have something else going for them, or people wouldn’t choose to live there. You can think of this “something else” as quality of life, broadly construed to include not simply bicycle paths and a music scene, as urbanist Richard Florida would have it, but more important things like weather, education, and public safety. There is a strong positive relationship between this quality-of-life variable and entrepreneurial activity, as measured by smaller firms or by employment growth in new start-ups. That’s because productive, entrepreneurial people like pleasant environments.

This means that entrepreneurship in New York depends, in part, on policies that seem to have little to do with entrepreneurship. The increasing safety of New York’s streets, which did so much to make the city more pleasant, was also an economic-development strategy (see “New York’s Indispensable Institution,” in City Journal’s 2009 special issue, “New York’s Tomorrow”). And there may be no more important element in New York City’s quality of life than its schools. Education, at all levels, enhances entrepreneurial success because good schools attract skilled parents and create a skilled workforce. A large literature shows the role that universities play in generating innovations that help the firms that surround them. New York can survive, despite its taxes and regulations, only by being smart, and stronger schools help make that happen.

Great American cities were never built by their governments; the true heart of a city is the entrepreneurial energy that it contains. That rule applies especially strongly to New York, a city that will never be a good place for firms that want to stand still and produce as cheaply as possible. Rather, New York’s survival hinges on coming up with new ideas and new businesses. For centuries, Gotham thrived on the entrepreneurial energy of people like Jeremiah Thompson and A. E. Lefcourt. The task ahead is to ensure that it remains a place where new ideas can blossom and where new businesses can start.

Research for this article was supported by the Brunie Fund for New York Journalism.

Photo by Lewis Hine/National Archive/Newsmakers