Among Bernie Sanders’s many proposals during his presidential run was a plan for Washington to spend $1 trillion on public infrastructure. Progressives love such proposals. Just tax the rich enough, they say, and we can build superfast trains, new roads, revamped airports, and other things that (purportedly) will bring widespread prosperity and greater equality from California to Montana to Maine. President Barack Obama has done his best to further this vision. He began his first term pumping $48.1 billion into infrastructure spending, via the 2009 American Recovery and Reinvestment Act (otherwise known as the stimulus package), and is ending his second term with a proposal to spend $73 billion more on infrastructure.

The progressive romance with infrastructure spending is based on three beliefs. First is that it supercharges economic growth. As President Obama put it in his 2015 State of the Union address: “Twenty-first century businesses need twenty-first century infrastructure.” Further, by putting people to work building needed things, infrastructure spending is an ideal government tool for fighting unemployment during recessions. Infrastructure should also be a national responsibility, progressives believe, led by Washington and financed by federal tax revenues.

Finally, a reason to check your email.

Sign up for our free newsletter today.

None of this is right. While infrastructure investment is often needed when cities or regions are already expanding, too often it goes to declining areas that don’t require it and winds up having little long-term economic benefit. As for fighting recessions, which require rapid response, it’s dauntingly hard in today’s regulatory environment to get infrastructure projects under way quickly and wisely. Centralized federal tax funding of these projects makes inefficiencies and waste even likelier, as Washington, driven by political calculations, gives the green light to bridges to nowhere, ill-considered high-speed rail projects, and other boondoggles. America needs an infrastructure renaissance, but we won’t get it by the federal government simply writing big checks. A far better model would be for infrastructure to be managed by independent but focused local public and private entities and funded primarily by user fees, not federal tax dollars.

Building infrastructure is no surefire way to stimulate economic growth, as Japan’s example shows. After decades of strong economic expansion, Japan experienced a massive asset bubble in the late 1980s, with the Nikkei 225 reaching 38,500 in December 1989. The next year, the bubble burst and the index began falling precipitously, dipping below 15,000 by August 1992 and never recovering—indeed, by 2001, it had dropped below 10,000. Even today, the index is only slightly above 17,000. Japan’s dismal stock-market performance has been matched by little or no economic growth. Per-capita GDP, in constant U.S. dollars, was no higher in 2009 than in 1991, according to OECD data. The Japanese economy picked up slightly this year, but it’s fair to say that Japan has lost a quarter-century of growth.

To help fight this economic sluggishness, Japan has invested enormously in infrastructure, building scores of bridges, tunnels, highways, and trains, as well as new airports—some barely used. The New York Times reported that, between 1991 and late 2008, the country spent $6.3 trillion on “construction-related public investment”—a staggering sum. This vast outlay has undoubtedly produced engineering marvels: in 1998, for instance, Japan completed the Akashi Kaiky¯o Bridge, the longest suspension bridge in the world; just this year, the country began providing bullet-train service between Tokyo and the northern island of Hokkaido. The World Competitiveness Report ranks Japan’s infrastructure as seventh-best in the world and its train infrastructure as the best. But while these trillions in spending may have kept some people working, no one can look at the Japanese numbers and conclude that the money has ramped up the growth rate. Moreover, the largesse is part of the reason that the nation now labors under a crushing public debt, worth 230 percent of GDP. Japan is less, not more, dynamic after its infrastructure bonanza.

Infrastructure spending is a form of investment: just as building a new factory can boost productivity, laying down a new highway or opening a new airport runway can, at least in principle, generate future economic returns. But the relevant question is: How do those future returns compare with the costs? Just because infrastructure is a form of capital doesn’t mean that spending a lot on it is always smart. When a firm estimates the rate of return for a new factory, it can calculate the expected net profits and compare those with the expense. The analog for, say, new or improved roads is to estimate the benefits to users from reduced travel times, add the likely modest spillover benefits to nonusers, and then subtract the spending needed to construct and maintain the infrastructure. The results can differ significantly across projects. A well-known 1988 Congressional Budget Office survey found that spending to maintain current highways in good shape produces returns of 30 percent to 40 percent—but that new highway construction in rural areas showed a much lower return. A clever study that used firm inventories estimated that the rate of return to new highways was sizable during the 1970s but sank below 5 percent during the 1980s and 1990s.

Returns can vary substantially for other forms of infrastructure, too. One study found that adding a new runway to New York’s hectic LaGuardia Airport would generate considerable value, but adding one to San Antonio’s less frantic international airport would bring little benefit. Busy airports are likely to be worth improving; others, less busy, may not be. California’s huge investment in high-speed rail was justified by a 2014 cost-benefit analysis that Parsons Brinckerhoff, the firm building the rail system, had prepared. The report predicted that total benefits from the project would range from $66 billion to $80 billion over several decades. That number looked reasonable when the projected price tag for the project was $35 billion, but the budget has already swollen to $68 billion—and is still expanding. In 2009, I calculated a rough cost-benefit calculation for a (fictional) high-speed rail link between Houston and Dallas and found that costs outweighed benefits by an order of magnitude. The returns to high-speed rail tend to be limited because air travel will still be faster and driving a lot cheaper. Outside the East Coast, meantime, train travelers would typically still have to rent a car once they arrived at their destination. President Obama’s grand vision of “walking only a few steps to public transportation, and ending up just blocks from your destination” is at odds with reality in car-centered America. Has the president never been to Houston?

The existence of plausible transportation alternatives and the law of diminishing returns have also tended to reduce the benefits of infrastructure investment over the past two centuries. The opening of the Erie Canal in 1821 brought enormous value because the inland transportation options at the time were dismal. In the early nineteenth century, it cost as much to ship goods 30 miles over land as to send them across the entire Atlantic Ocean. Yet the very existence of canals, as much of a breakthrough as they represented, reduced the benefits of the later rail system, as Nobel economist Robert Fogel has shown. The returns for new transportation infrastructure in places with terrible roads, such as much of Africa and India, will be much higher than in the United States, which already enjoys an impressive, if under-maintained, array of mobility options.

What about the economic value of the shorter commuting times that new infrastructure can bring? Between 2009 and 2014, the Texas Transportation Institute estimates that the annual cost to Americans from traffic rose from $147 billion to $160 billion and that hours wasted in traffic increased from 6.3 billion hours to 6.9 billion hours, despite the surge in federal transportation funding. The time wasted has been particularly egregious in America’s more successful metropolitan areas, like San Jose, where delays per auto commuter jumped from 56 hours in 2009 to 67 hours in 2014. Yet it’s hard to see how substantially reducing time lost to traffic congestion will turbocharge the economy. Imagine that America gets its act together and cuts traffic time sufficiently to save $80 billion—a pretty miraculous improvement. That would still represent less than one-half of 1 percent of America’s $18 trillion GDP.

Given such numbers, infrastructure advocates have downplayed standard cost-benefit analysis in favor of broad macroeconomic surveys, which look at the statistical link between public-infrastructure investment and overall economic activity. This method allegedly enables one to capture all the spillover economic effects of infrastructure. Standard cost-benefit analysis, these advocates say, misses the new businesses and jobs and ideas that will blossom because of the cheaper costs of transportation, as people move about and interact more freely.

Yet this macroeconomic approach can produce imprecise—and even wildly misleading—results. For example, if infrastructure gets built in anticipation of an expanding economy, the statistics will suggest that the new construction caused the expansion. A classic 1989 study by economist David Aschauer showed that postwar national growth rates improved after increases in public-sector capital-stock spending, but that hardly proves that infrastructure caused the growth. In 1990, Alicia Munell conducted a similar study for the Federal Reserve Bank of Boston focusing on state-level data. While these early studies showed high returns to infrastructure, later work has found the results quite fragile. High estimated returns often vanish when researchers control for common state trends or other economic variables.

I recently advised a Ph.D. student, Andrew Garin, studying the impact of the American Recovery and Reinvestment Act’s highway spending on county-level employment. Garin’s estimates show that highway projects had essentially zero effect on local employment, four years after the onset of the recession. The projects may have raised employment in the counties of the contractors—the statistical results are ambiguous—but he found no impact on the counties where the projects were built. The extra infrastructure, in other words, does not seem to have improved economic vitality anywhere that it might have been expected to.

This isn’t to say that new transportation infrastructure isn’t valuable—I’d be thrilled to save an hour a week in commuting time. But that extra hour is unlikely to turn me into a vastly more creative and innovative person. Transportation infrastructure isn’t a solution for America’s lackluster growth rates.

Nor is transportation infrastructure a useful tool to fight joblessness during temporary economic downturns. The idea of using infrastructure building as a weapon against unemployment first entered American politics after the economic panic of 1893. Before that recession hit, in 1891, businessman and Ohio politician Jacob Coxey drafted his “Good Roads Bill.” Coxey wanted the government to spend at least $20 million per month building roads across America, paying workers “at least 80 percent above the going hourly rate.” This building campaign, he argued, would be financed by the printing press—Coxey was a pro-inflation Greenback Party member—and would hike government spending by 75 percent. Coxey is best remembered for the unorthodox manner in which he made his case in 1894: marching to Washington with hundreds of supporters. “Coxey’s Army” failed to persuade Congress to support the Good Roads Bill, but its central idea remained in the air.

That idea received a major boost during the Great Depression. President Hoover’s 1930 State of the Union address announced that, to fight the economic collapse and provide jobs, the federal government was “engaged upon the greatest program of waterway, harbor, flood control, public building, highway, and airway improvement in all our history.” Hoover favored “still further temporary expansion of these activities in aid to unemployment during this winter.” The distinguished Columbia economist John Maurice Clark praised Hoover’s public-works promotion as a “great experiment in industrial statesmanship of a promising and novel sort.”

Franklin Delano Roosevelt followed Hoover’s lead on a much grander scale. The Civil Works Administration, the Public Works Administration, and the Works Progress Administration hired huge numbers of the unemployed and built infrastructure projects across the country. Roosevelt’s friendship with New York City mayor Fiorello LaGuardia helped ensure that Gotham’s infrastructure got a particularly impressive upgrade. The Lincoln Tunnel, LaGuardia Airport, and the Triborough Bridge—all were Public Works Administration projects. The nation’s generally positive view of these ambitious undertakings helps sustain the view that Coxey was right: building infrastructure can put people to work and reduce the pain of a downturn.

Yet one should be wary of drawing infrastructure-related lessons from the 1930s for the twenty-first century. First, most of the U.S. had real infrastructure needs in the 1930s, so the risk that all those formerly unemployed people would be put to work on highly wasteful projects was relatively low. These days, the conditions are sharply different. While a sensible anti-unemployment policy targets resources at areas that have high unemployment rates, many of those areas are today in long-term decline, and the last thing they need is new roads and bridges. For example, Detroit’s infrastructure was built for 1.85 million people; now, after decades of difficulty, the city has less than half that population. New construction there makes no sense and would just squander money.

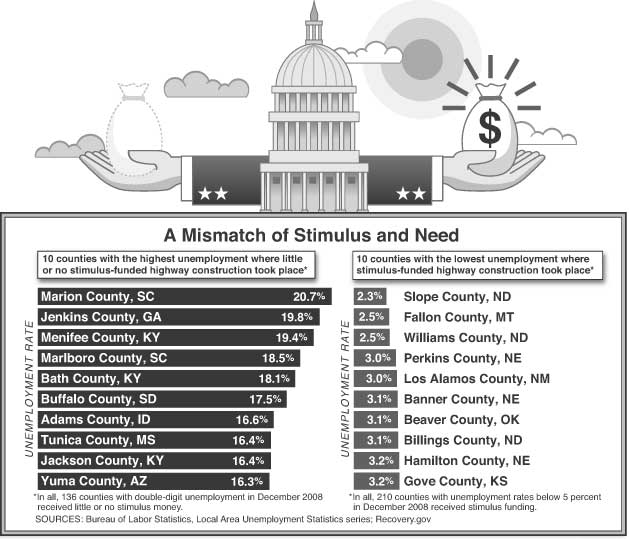

As it turns out, Recovery Act highway spending seems to have gone to low unemployment areas, as the chart on page 29 shows, which means that the funding was less likely to reduce joblessness and more likely just to shift workers away from other jobs. That’s doubtless what has happened with the last of Massachusetts’s recession-birthed mega-bridge projects, the ongoing Braga Bridge construction in Fall River. That town is unquestionably depressed, with a fearsome double-digit unemployment rate, but the project’s contractor is based in Canton, Massachusetts—where unemployment is a healthily low 4.6 percent.

The relatively simple technology of infrastructure construction of the 1930s meant that the unskilled unemployed could easily be put to work building roads. Among the iconic images of the Great Depression are scores of men wielding shovels and picks. That isn’t how roads and bridges are built anymore, though. Big infrastructure requires fancy equipment and skilled engineers, who aren’t likely to be unemployed. The most at-risk Americans, if they’re working at all, usually toil in fast-food restaurants, where the average worker makes $22,000 a year. They’re typically not trained to labor on complex civil-construction projects. Subsidizing Big Mac consumption would be a more effective way to provide jobs for the temporarily unemployed than subsidizing airport renovation.

The building process was also much quicker in the past, meaning that projects proposed during the Depression could be started and even finished during the Depression, making them more likely to fight temporary joblessness. Robert Moses built the Triborough Bridge complex, the construction of which got under way on Black Friday in October 1929, in just four years. Such speed is hard to imagine today. Boston’s Big Dig, to take one famous example, took 25 years from initial planning to its final completion in 2007. (See “Lessons of Boston’s Big Dig,” Autumn 2007.) Why have transportation projects become so much slower? Yes, they’re usually more technologically complicated, but much of the time, politics is also to blame. As Alan Altshuler and David Luberoff chronicle in their masterful book Mega-Projects, earlier urban-infrastructure initiatives proceeded without worrying much about community opposition. To erect the Triborough, Moses could just demolish the buildings that he needed to get out of the way—neighborhood complaints be damned. Such tactics are no longer politically acceptable, so the Big Dig and other large-scale undertakings needed painstakingly to avoid inconveniencing anybody, dramatically raising costs and delays. New Deal projects also didn’t face environmental-impact reviews, which can add years to a project timeline. Detroit’s Gordie Howe International Bridge’s review process took “four years of consultations, public hearings, traffic analyses, and environmental studies,” to take a recent example. The project should be finished around 2020—15 years after that review process began.

This is not to dispute that transportation spending eventually creates jobs. But are they a good bargain? The ratio of Recovery Act transportation spending “outlayed or expended” ($33 billion) by 2012 to direct job-years created (113,347), as reported by contractor, is $295,000. Transportation spending also creates jobs indirectly, through the materials and machines used by the construction contractors; if we take those positions into account, the ratio falls to $114,000 per job-year created. These estimates may still be too high because each direct dollar of government spending leads to more consumer spending, as transportation workers buy new clothes and cars—but they may also be too low, since many of these workers, as we’ve seen, would have been employed anyway. The Council of Economic Advisers uses a number, based on prerecession studies, of $92,000 per job-year for all government spending.

To my eyes, even $92,000 per job-year seems too expensive. (The average worker in the U.S., it’s worth noting, earns only about $40,000 annually.) Putting to work 10 million unemployed Americans in 2009 would have required $1 trillion in government spending per year. Cutting the payroll tax for poorer workers seems like a more efficient way to get firms to hire more people.

The third prominent infrastructure illusion is that transportation should be a centralized, tax-funded federal responsibility, rather than decentralized, user-fee-funded local responsibility. The most pressing problem with federal infrastructure spending is that it is hard to keep it from going to the wrong places. We seem to have spent more in the places that already had short commutes and less in the places with the most need. Federal transportation spending follows highway-apportionment formulas that have long favored places with lots of land but not so many people. For example, Alaska received $484 million in the 2015 highway-aid apportionment, which included support for metropolitan planning and air-quality improvement. This works out to about $657 for each Alaskan. Massachusetts received $586 billion, which amounts to roughly $87 per person. New York State received $1.62 billion, or $82 per person. Do these spending patterns reflect far greater transportation needs in Alaska than in New York City or Boston? No: the average commute time in Anchorage is 23 minutes, less than the national average, while the averages in Boston and New York are 30 minutes and 36 minutes, respectively.

Alaska’s federal highway-aid haul is all too typical, unfortunately. Recovery Act transportation aid was twice as generous, on a per-capita basis, to the ten least dense states than it was to the ten densest states, even though higher-density areas need more expensive infrastructure (retrofitting New York with tunnels and bridges, for example, is far costlier than building in the greenfields of the West). Low-density areas are remarkably well-endowed with senators per capita, of course, and they unsurprisingly get a disproportionate share of spending from any nationwide program. Redirecting tax dollars across jurisdictions is rarely fair—and it isn’t right, either, that poorer, lower-density regions should subsidize New York’s subway and airports.

Washington’s involvement also distorts infrastructure planning by favoring pet projects. The Recovery Act set aside $8 billion for high-speed rail, for instance, despite the fact that such projects would never be appropriate for most of moderate-density America. California was lured down the high-speed hole with Washington support, but many voters now seem to regret that they took the bait. In a 2015 poll, 53 percent of respondents said that they would vote for “a ballot measure ending the High Speed Rail project and spending that money on water storage projects.” Only 31 percent said that they would vote against that measure.

Idiosyncratic, foolish projects existed long before the Obama administration. Detroit’s infamous People Mover Monorail would never have been built without federal aid. Alaska’s $400 million Gravina Island bridge to nowhere was a particularly notorious example of how Congress abuses transportation investment. As the Office of Management and Budget noted, during the Bush years, highway funding was “not based on need or performance and has been heavily earmarked.”

The Recovery Act largely left decisions about individual projects to the states, but it required them to move quickly. In some cases, this led to simple maintenance projects, like repaving, which usually make sense. But when it came to larger-scale investments, the push for speed ran the risk of poor planning. The Dulles Corridor Metrorail Project, the costs of which greatly exceed its potential benefits, seems unlikely to have moved ahead without the $900 million in federal assistance that it received in 2009.

Funding infrastructure with general tax revenues removes the discipline that comes when projects need to pay for themselves. If every new road or rail project had to fund itself, the projects that deliver the greatest benefits would be the ones that move ahead. If people are willing to pay to use infrastructure, we can assume that that infrastructure provides social value.

A user-fee approach is also fairer. With general tax financing, every American must pay for new highways in Montana, regardless of whether they drive or have ever been to Montana. It’s much fairer for the people who use roads to pay for roads.

User-fee financing is even more attractive because it helps reduce congestion. Building more highways will never decongest America, for counterintuitive behavioral reasons. Economists Gilles Duranton and Matthew Turner have empirically identified the Fundamental Law of Road Congestion, which is that highway miles traveled increase roughly one-for-one with highway miles built. If we build it, people will drive it. The correct fix for crowded roads is to charge people for the social costs of their choices. Singapore instituted congestion pricing in 1975, and now operates state-of-the-art electronic road pricing, with tolls that vary by usage and time of day. London has now had congestion pricing for a decade. Both cities have eased traffic as a result. Yet America still acts as if charging drivers is a crime. For decades, federal rules prevented the levying of tolls on interstate highways. The Obama administration deserves credit for supporting the possibility of tolling the system.

The federal role in transportation should be limited to certain key tasks. Washington can certainly help coordinate local investments to improve the functioning of a national transport network, as it did when building the Eisenhower Interstate Highway System. The federal government should maintain safety and maintenance standards, on the road and in the air, and can nudge localities to maintain their infrastructure. Finally, it can encourage transportation, especially buses, that helps the poor find jobs. But none of this requires a massive national spending spree.

Many tasks of government have nothing in common with private enterprise. Neither our military nor our courts should be in the business of extracting revenues from, respectively, foreign powers or litigants. Aid to the poor and to the elderly is meant to be money-losing. But infrastructure is different and has much more in common with ordinary businesses. After all, infrastructure provides valuable services, the use of which by one individual typically crowds out the use by someone else. E-ZPass technology has made it simple to charge for transportation. Why not, then, establish a business model for transportation infrastructure?

The upsides would be substantial. When businesses running, say, a public road need to recoup their costs over years and decades, they have a strong incentive to maintain the infrastructure properly. A transportation business model also avoids the messy redistribution of the current system, where some states subsidize others and non-travelers subsidize the mobile. In some cases, the business model for transportation might be completely private. The Route 91 Express Lanes are private roads built within the median of California’s Riverside Freeway. For 20 years, they have charged varying tolls based on time of day, and drivers have proved willing to pay. The Orchard Pond Parkway in Florida is another private road. Private airports operate in America and across the globe, and, in many cases, such private infrastructure has performed extremely well. Clifford Winston, a distinguished transportation economist, has argued for the privatization of all of America’s highways. That would be a difficult task, however. While drivers usually accept tolls for new roads, they hate tolls slapped on to previously free roads. Consequently, it’s easier politically to fund new projects with user fees than to impose them on older infrastructure. Any new project thus should come with a user charge, right from the start.

Private ownership isn’t the only sensible model for transportation. Private control raises the specter of monopolistic pricing that harms consumers, though this can be addressed with reasonable regulation. Or, if transportation still needs government funding—perhaps because we want a subway system to reduce congestion on unpriced streets or because we want buses to provide cheap mobility for the poor—private operators might pressure the government to increase their subsidies excessively. Americans may feel more comfortable if many projects remain in public hands.

When we can’t go private, another plausible option is an independent, but public, entity. In some cases, independent public entities have worked well, putting the focus on service rather than on politics. Robert Moses’s Triborough Bridge Authority maintained both its bridges and its first-class credit rating for decades, despite the turbulence of New York politics. Many of America’s airports are well run, despite public ownership. But taking this path requires intensely focused management. Few mayors or governors can run an airport on top of their day jobs. New York’s notoriously corrupt and inefficient Port Authority provides a telling example of what can go wrong with this model. (See “Let’s Break Up the Port Authority.”)

A shift to an expanded role for the private sector in infrastructure construction and maintenance thus seems like a good bet. And America is not short on private-sector transportation innovators. Our cars are more technologically impressive than ever. American freight rail is a wonder of the world. Cheap bus services ride up and down I-95. Uber and Zipcar have upgraded urban mobility for the Internet age. The parts of the transportation system competitively produced by the private sector are in great shape; the parts folded within the public sector are often, though not always, an embarrassment.

Economics teaches two basic truths: people make wise choices when they are forced to weigh benefits against costs; and competition produces good results. Large-scale federal involvement in transportation means that the people who benefit aren’t the people who pay the costs. The result is too many white-elephant projects and too little innovation and maintenance.

No one denies that the United States suffers gaping infrastructure deficiencies, including potholed roads, unsafe bridges, and awful airports. But we also have a dreary history of federally supported infrastructure boondoggles. America spends too much time arguing about whether to spend more money or less on infrastructure—including as a jobs program—and far too little time on how to construct and maintain infrastructure wisely. Treating transportation infrastructure as yet another public-works program ensures the mediocrity that we see all around us. A wise approach means, contrary to Bernie Sanders, a much diminished federal role and a lot more transportation initiatives that look like private industry, with users paying for the services they receive.

Top Photo: Once upon a time, America built crucial infrastructure, like New York’s George Washington Bridge, speedily and efficiently. (The Museum of the City of New York /Art Resource, NY)