When the financial hurricane struck in 2008, Britain found itself in a crisis very much like the American one. A giant credit bubble had fueled an unsustainable rise in the price of real estate. British homeowners, feeling rich, had spent and spent, pushing up their household debt to a staggering 106 percent of GDP, up from 61 percent just eight years earlier. When the bubble burst, hitting house prices and making people feel poorer and afraid, British consumers went on strike; employers promptly imitated them, and the United Kingdom lost 1.6 percent of its jobs between 2008 and 2009. (America, with its easier hire-and-fire culture, lost 5 percent.) With bubble-era tax revenues gone, a British government deficit that had seemed manageable became cavernous, expanding from 3.5 percent of GDP over the 2004–08 period to 11.5 percent in 2009.

In the spring of 2010, David Cameron ran for Britain’s prime ministership, promising to tell the truth about the country’s fiscal mess and to take the unpopular steps needed to clean it up. Britain was laboring under “the biggest budget deficit of any developed country in the world,” Cameron warned in a televised debate. “If we think that the future is just spending more and more money, we’re profoundly wrong.” British voters, terrified that investors would cut their nation off from global bond markets, ditched the incumbent Labour Party, which had been in power for a decade, and gave Cameron’s Conservative Party a plurality in Parliament. Another party, the Liberal Democrats, joined the Conservatives as the junior partner in a coalition that came to power that May. Rather than bicker and stall, the Conservatives and the Lib Dems—which, like America’s two major parties, hailed from opposite sides of the ideological spectrum—had agreed to get along in order to shrink the enormous deficit.

Finally, a reason to check your email.

Sign up for our free newsletter today.

These seemingly functional politics, however, have produced an economy marked by nonexistent growth. Britain hasn’t fixed the fisc: the Moody’s credit-rating service cut Britain’s triple-A rating a notch in February, something that Cameron had said that his budget would prevent. And public services are deteriorating at an alarming rate. For the many American pundits who insist that Republicans and Democrats should make compromises and moderate their own stances on deficit reduction—lower spending and higher taxes, respectively—the British experience should serve as a warning.

In June 2010, Cameron sent his chancellor of the exchequer, George Osborne, to Parliament to present an emergency midyear budget. Osborne wanted to slash annual spending by £40 billion (about $60 billion) to get Britain off the “road to ruin,” he said. Echoing Cameron in slightly different terms, Osborne told lawmakers that the government had inherited “the largest deficit of any economy in Europe” except Ireland—“this at the very moment when fear about the sustainability of sovereign debt is the greatest risk to the recovery of European economies.” To avoid the investor flight that would precipitate a public debt crisis, as was happening in Greece, an austerity budget was “unavoidable.”

The solution was spending cuts, not higher taxes, Osborne continued, since “the country has overspent. It has not been undertaxed.” The goal was “an economy where the state does not take almost half of all our national income.” Osborne cited empirical evidence to back him up. The International Monetary Fund had found that budget fixes delivered “through lower spending are more effective at correcting deficits and boosting growth than consolidations delivered through tax increases,” he said (see “The Kindest Cuts,” Autumn 2012).

But there was a catch, Osborne said. Though tax raises weren’t good policy, they were a handy tool for reducing deficits immediately. Deep spending cuts, by contrast, would take time to enact: officials would need to figure out what the government spent money on and then determine where to cut and by how much. So the government would follow an “80:20 rule of thumb,” promised Osborne: “roughly 80 percent” of deficit reduction would come from lower spending and 20 percent from extra taxes.

The actual figures that Osborne gave showed that he planned to take 77 percent of the reduction from the spending side and 23 percent from taxes. And the spending cuts would kick in much more slowly than the tax hikes. For the first year, cuts would constitute just 59 percent of deficit reduction, and by 2012, their share had actually fallen; the promised 77 percent wouldn’t arrive for five years. The tax slam, though, came immediately. Today, British taxpayers shoulder an annual burden that’s £21 billion heavier than it was before the coalition took power—a 4.4 percent increase. Taxes will rise by another £5 billion next year.

The coalition has done some good things on the tax front. Most significantly, they’ve cut the corporate tax rate for large companies from 28 percent to 24 percent, a smart change meant both to encourage firms to move jobs to the United Kingdom and to discourage the widespread legal tax avoidance that has put Starbucks and Microsoft in tabloid headlines for their tiny British tax bills. Also, as part of a laudable policy of rewarding work, not welfare, the coalition increased the amount of money that people could earn each year without paying income taxes, from £6,475 to £8,105.

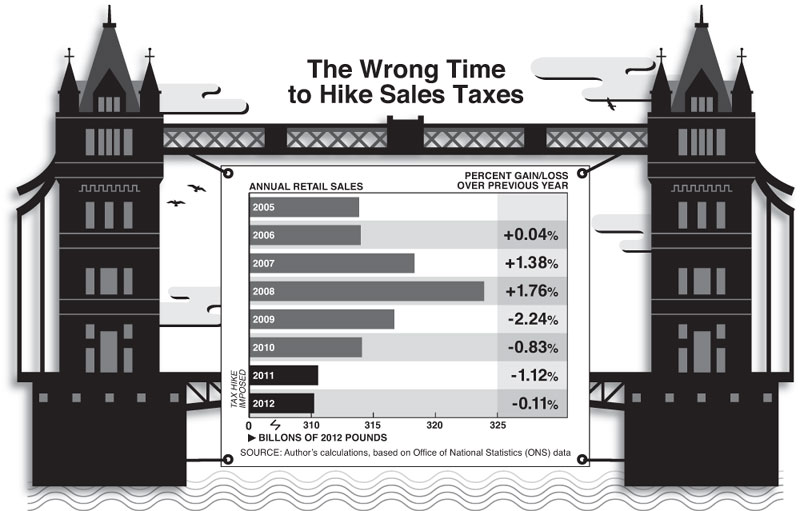

Unfortunately, the bad tax policy outweighs the good. To raise £13 billion yearly—the biggest share of the government’s overall tax grab—Cameron and Osborne walloped every Briton with a massive increase in a tax that most people paid almost every day: the value-added tax, a sort of sales tax on everything from adult clothing to restaurant meals, though not on groceries or books. Just after Christmas 2010, the VAT rose from 17.5 percent to 20 percent. “The years of debt and spending make this unavoidable,” Osborne said glumly in his emergency speech. The money raised would be money that “we don’t have to find from extra spending cuts or income tax rises.” (Back in late 2008, right after Lehman Brothers collapsed, Labour prime minister Gordon Brown had taken the opposite tack: to try to encourage spending, he temporarily slashed the VAT to 15 percent.)

Osborne may be adept at reading a page of projected spending and revenue numbers and trying to make them meet somewhere in the middle, but he and the rest of the coalition seemed oblivious to how flesh-and-blood people would react to the VAT increase. Consumer spending was already falling, having dropped by 2 percent (after inflation) in 2009 and by another 1 percent in 2010. The higher VAT prolonged the slump. Consumer spending fell by 1 percent in 2011 and remained flat last year. Vacant storefronts and bankrupt retailers have ruled British front pages for years now. “Thousands more shops could close in the coming year leaving one in six stores empty,” the Financial Times reported this February. The paper cited research finding “more than 35,500 empty shops and a national vacancy rate of 14.2 percent across the country’s top 650 town centres.” Analyst Richard Hyman says that the VAT increase “inevitably exacerbated” the forces already battering British retail, which included not only fallout from the financial crisis but also the rise of Internet shopping and the higher cost of imported Chinese-made goods. Because retailing is a low-margin industry, Hyman adds, a 2 percent loss in sales equals “one-third of the profit margin,” even if a retailer is operating efficiently. To stay in business, stores therefore had to cut costs, and their biggest cost was people. Between 2008 and 2012, the retail industry lost 197,000 jobs—3.9 percent of the total, a fraction seven times bigger than in the rest of the workforce.

All that economic pain notwithstanding, the coalition government has reaped the VAT revenues that it anticipated only thanks to persistent inflation, which has pushed up the price of goods and the resulting tax haul. This year, Britain plans to slap retail yet again, this time by raising property-tax rates for businesses.

A second major tax increase, this one on the wealthy, didn’t come close to bringing in the revenues that the coalition expected. In early 2010, Osborne waved through Brown’s earlier plan to boost income taxes by 25 percent for people earning more than £150,000 annually, for a top rate of 50 percent. It was the first such increase in three decades, and it backfired. Wealthy people, who had already lost income during the crash, worked less or moved their income to avoid the levy. As Osborne acknowledged two years later, “the behavioural response has been larger than expected.” Supposed to raise £2.5 billion annually, the hike raised £1 billion or less—and once enough time passes, the government has concluded, “it’s quite possible” that the result “could be negative.”

The coalition, admitting its mistake, changed course and brought the top rate down to 45 percent this year. In Osborne’s words: “The government believes it is neither efficient nor fair to maintain a tax rate that is not effective at raising revenue from high earners and risks damaging growth.” Still, the tax remains 12.5 percent higher than it was before the coalition came to power. And in another move to soak the rich, the coalition nearly doubled the tax rate for capital gains, to 28 percent.

Other recent tax changes have hit the middle class. The coalition has begun to take away child tax credits at the £40,000 to £50,000 threshold, for instance, and pushed households making just over £30,000 into a higher marginal tax bracket. According to government figures, people in the middle class are £200 worse off, on average, than they were before the coalition’s reforms. And though someone earning £40,000 (roughly $60,000) is indeed in the top 20 percent of British earners, he probably won’t pay £300 more in taxes annually—the average hit for the upper middle class—without feeling it, especially if he lives near expensive London. The middle class, moreover, has borne the brunt of higher tuition fees at public universities, a cost that doesn’t show up in the tax figures.

Not that the poor and lower middle class are benefiting from all the new government revenue. The tax changes have left the poorest 10 percent of families—those making less than £14,200 annually—nearly £100 worse off, on average, according to the same government figures. Again, the coalition raised the level of earnings exempt from income taxes; but during the coalition’s first year in power, that benefit to the poorest was more than offset by the VAT hike alone.

British taxpayers aren’t paying into a more efficient tax system, either. The coalition government had promised full-scale reform that would end distortions in the tax code and make it simpler. Aside from the straightforward corporate-tax cut, however, all Osborne has done with the code is a lot of confusing tinkering. “Overall the tax system is probably more complicated than it was when they came to power,” said Matthew Sinclair, head of the nonprofit TaxPayers’ Alliance, in early 2013. The coalition has cut taxes for the video-gaming industry, for example, but elevated them for the oil and gas industry. Taxes on airplanes are up, but taxes on fuel purchases are down. Taxes on savings accounts are down, but taxes on venture-capital trusts are up. Taxes on alcohol and gambling are up and down (but mostly up). In January, the TaxPayers’ Alliance compiled a spreadsheet of 254 tax increases and 109 tax cuts that the coalition had enacted in three years.

Last year, Osborne’s tinkering devolved into farce. In his 2012 budget, he moved to classify warmed-over Cornish pasty, a sort of meat pie, as a hot food, so that the government could levy the VAT on it as though it were a restaurant meal. An accountancy firm weighed in during the ensuing controversy, saying that the hot tax shouldn’t apply, since bakeries heat pasties solely for “aromatic” reasons. The public outrage over the “pasty tax,” as the tabloids dubbed it, was so intense that Osborne had to scrap it.

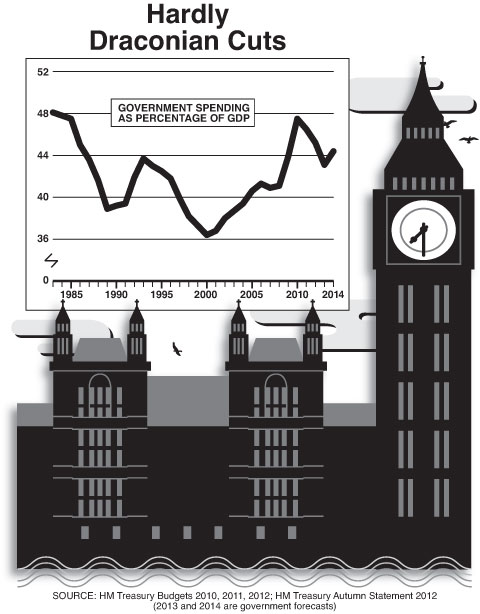

Though it has taxed aggressively, the coalition has been less than draconian in cutting spending. In his final budget document, in 2009, Prime Minister Brown had proposed to spend £646 billion for the fiscal year ending in 2011, up from £601 billion the previous year. In his first budget, Osborne lowered Brown’s £646 billion to £637 billion, and the government ended up spending even less than that: £629 billion. The deepest austerity that Britain had seen in a generation, then, was a 4.7 percent spending increase relative to the previous year. Yes, spending must keep pace with inflation if it’s going to buy the same quantity of goods and services. But the coalition’s 4.7 percent increase exceeded Britain’s 2011 inflation rate, which peaked at 4.5 percent.

Nor was that first coalition budget an aberration. As of early March, the coalition’s budget for next year called for spending £672 billion. That represents 44.4 percent of GDP, higher than this year’s 43.1 percent and higher, on average, than at any time between the start of Margaret Thatcher’s premiership nearly three decades ago and the extreme spike that hit in the aftermath of the financial crisis. That hasn’t stopped Cameron and Osborne from continuing to congratulate themselves, more than halfway through their five-year term, for cutting spending relative to the profligacy of the preceding Labour government.

One flaw in the coalition’s spending cuts involved what it decided to cut. Like many Western leaders, including America’s, Cameron and Osborne thought that touching health-care entitlements would be political suicide. (They also “ringfenced” the foreign-aid budget, which was at least a principled decision, since the British press hasn’t found any voters in favor of such spending.) It wasn’t so surprising that the coalition opted not to go where the money was. After all, it didn’t dare to challenge benefits for the elderly—such as free bus passes, which they get regardless of their income, and “winter fuel allowances,” even for those who live abroad in warmer climes.

Inconveniently, though, Britain’s £103 billion health-care bill—nearly all of which goes to the National Health Service (NHS), the country’s socialized health-care system—consumed almost one-sixth of the government’s total spending. To protect health care, Cameron and Osborne had to force harsher reductions onto the rest of the budget. In fact, Osborne’s long-range plan allows the NHS to keep growing while forcing the transportation agency, for example, to take a haircut of 21 percent in real terms. Making more room for the NHS has also eaten into Britain’s capital budget, which covers long-term infrastructure investments and would take a 29 percent capital hit over four years, far greater than the operating budget’s 8.3 percent cuts. And since 2010, the defense budget has fallen from £38 billion (in today’s pounds) to £27.6 billion.

A second flaw in the coalition’s budget-cutting was that the government merely shifted some of its spending burden onto localities. Osborne slashed London’s grants to local governments by 27 percent in real terms over a projected four years. Because such grants had constituted 55 percent of local-government spending, this was a big deal, and it meant whopping service cuts. Over the last three years, local British governments have shuttered libraries, laid off workers, and raised nuisance fees.

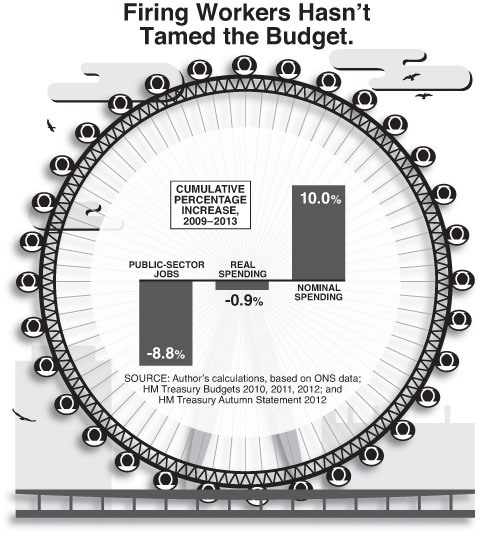

Making the cuts still worse was that they didn’t help the budget situation much. Since the coalition came to power, Britain has jettisoned 554,000 government jobs, 8.8 percent of the precoalition total. The public-sector workforce is now the same size that it was in 2002. But spending, again, hasn’t fallen commensurately. Why not? For a clue, take a look at who got the pink slips: police numbers are down by 10 percent, while NHS ranks are flat. With spending on health care still rising, rolling back other services and laying off government workers don’t make enough of a dent in the budget.

Like its tax policies, some of the coalition’s spending cuts make sense. The government has capped welfare benefits so that “people are better off in work than on benefits,” as Cameron puts it, saving £5 billion annually. And the coalition has shrunk the number of people on disability by 145,000 by aggressively assessing “whether they are capable of working,” another smart move, since fraud is rampant. The government will gradually increase the private-sector retirement age to 67, saving money. Cameron and Osborne want to save another £3 billion yearly on public-sector pensions, both by forcing current workers to pay more and by raising the retirement age for today’s younger workers. And the coalition froze public-sector pay for two years. (The freeze has expired, but Cameron has still kept public-sector wage growth below inflation, prompting government workers to strike in March.)

Yet these changes weren’t enough to slow the growth of the state immediately, as the coalition had unwisely pledged. The British press has eviscerated Cameron and Osborne over the past few months for missing various fiscal targets and for resorting to budget gimmicks, such as transferring the Royal Mail’s assets to the government and calling it a £28 billion shrinkage in infrastructure spending. Osborne should never have believed that he could achieve “sound public finances,” as he put it in his 2010 emergency speech, in just a few years and in the middle of a historic recession.

Britain’s economy hasn’t turned around. Its GDP in 2012 was 2.3 percent smaller (after inflation) than it was in 2007. Economic growth was flat at best last year; inflation, though lower than the 2011 peak of 4.5 percent, was still 40 percent above the government’s target of 2 percent; the unemployment rate remains high, just under 8 percent; and the threat of a new recession looms. Yes, official employment figures show slightly more jobs now than before the 2008 crisis, something that America can’t yet say. But those numbers may mask the true extent of economic weakness. The ranks of the self-employed, for example, have risen by 367,000 in four years, while those of people working for someone else are down 434,000. That shift can be a sign of healthy entrepreneurialism; it’s more likely a sign that many people are doing odd jobs to scrape by. Further, workforce productivity is way down, suggesting that many bosses have retained employees even with limited work for them to do. That may not be a problem in the short term; but over time, it will raise the cost of British-made goods, hurting the country in the global marketplace.

As for the budget outlook, that’s still grim. “Public sector net debt as a percentage of GDP will be falling in 2016–17, a year later than set out,” Osborne wrote last fall. But that’s only a projection, and it may be too rosy, as the public and politicians alike have grown tired of the coalition’s austerity measures. Cameron’s cabinet members in charge of security and other areas are openly questioning why they must make deeper and deeper reductions to their departments even as health care is protected from belt-tightening. “Backbenchers” in the Conservative Party, as well as Liberal Democrats and members of other parties, are calling for measures to help people with the rising cost of living. And in March, in a closely watched off-year regional election in Eastleigh, the Conservatives placed third, after the Liberal Democrats and the conservative U.K. Independence Party.

How did British austerity go so wrong, and what can America learn from the experience? One lesson is surely to avoid steep, sudden tax hikes. The coalition’s rapid tax slap got Britain no closer to its fiscal goals, since it harmed economic growth and hurt public support for deficit reduction.

Many budget watchers still maintain that, though the tax increases damaged the economy, they were necessary, since investors in British bonds might have balked at an even bigger deficit. But shouldn’t investors have been still more worried about Britain’s inability to curb the health and other social spending that comes with an aging population and a stagnant workforce? Cameron and Osborne should have focused on those long-term problems, rejecting new taxes and designing solid NHS reforms while waiting for the longer-term impact of the pension and welfare reductions to kick in. There’s no evidence that bond markets, which have remained complacent in Britain (just as they have in America), would have revolted at such a gradual course. Back in 2010, Cameron could have said: If we can’t figure out how to lower spending over five years, we’ll raise taxes then. What’s the harm in waiting?

The United States should pay particular attention to that lesson. President Obama, with the Republican House assenting, kicked off 2013 with an American version of the big VAT increase. To avoid the fiscal cliff, Congress axed a temporary cut in Social Security taxes, snatching $45, on average, out of every American family’s paychecks every two weeks. The payroll-tax increase may already have stalled the economy’s sputtering growth. “Where are all the customers?” fretted a Walmart executive in a February e-mail that was later leaked to the press. “And where’s their money?”

The other lesson from the coalition’s failure is still more sobering. No fiscal program—whether fiscal austerity, as in Britain, or fiscal stimulus, American-style—was going to cure the West’s woes in a matter of months. In Britain, Cameron and Osborne implied that the 2010 spending cuts would unleash instant private-sector growth: “Today we have paid the debts of a failed past and laid the foundations for a more prosperous future,” Osborne said in his emergency speech. In America, Obama made the mistake of saying that the 2009 stimulus program would quickly bring unemployment below 8 percent. But it took a long time to get into this mess. It may take even longer to get out.