How far have we distorted the Constitution that the Founders gave us, and how much does it matter? A phalanx of recent books warns that we have undermined our fundamental law so recklessly that Americans should worry that government of the people, by the people, and for the people really could perish from the earth. The tomes—Adam Freedman’s engaging The Naked Constitution, Mark R. Levin’s impassioned The Liberty Amendments, Richard A. Epstein’s masterful The Classical Liberal Constitution, and Philip K. Howard’s eloquent and levelheaded The Rule of Nobody (in order of publication)—look at the question from different angles and offer different fixes to it, but all agree that Americans need to take action right now.

Before we scramble, though, we had better understand just what happened. There’s no single villain. As these books show, all branches of government conspired over more than a century to turn the Constitution that the Framers wrote in 1787, plus the Bill of Rights that James Madison shepherded through the first Congress in 1789 and the Fourteenth Amendment ratified in 1868, into something their authors would neither recognize nor endorse.

Finally, a reason to check your email.

Sign up for our free newsletter today.

The signal feature of the 1787 Constitution was its prudent restraint. The Framers learned from hard Revolutionary War experience that their new nation needed a more powerful central government than the Articles of Confederation authorized. But they bestowed the requisite powers with a trembling hand, knowing that the men who would exercise them were not angels but humans, as fallible as all other men—and usually more so, since overweening ambition and self-interest, not patriotism, are the standard spurs to seeking office. Recognizing that electing your officials doesn’t ensure that they won’t become as tyrannical as the hereditary monarchs the colonists had fled, the Framers’ hemmed in and divided government authority, giving Congress only 19 specific powers that mostly concerned raising taxes, coining money, spending it on “the common Defence and general Welfare of the United States” (meaning keeping the country safe), building post offices and post roads (but not turnpikes and canals), regulating the armed forces, and making laws necessary and proper to carry out these limited functions. Constitution architect James Madison, always at the vortex of the fierce disputes over what measures these enumerated powers implied as necessary and proper, concluded—after serving for a quarter-century as a congressman, secretary of state, and president—that the bedrock constitutional principle was simply to ensure that America does not “convert a limited into an unlimited Govt.”

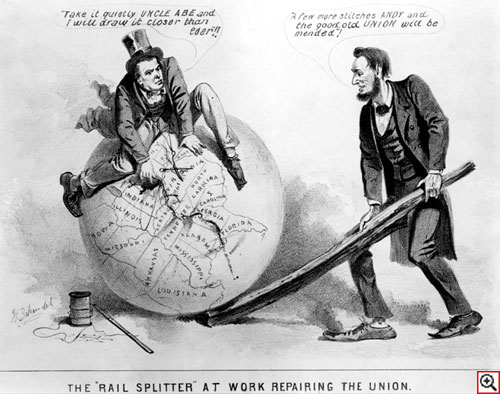

But before the nation started making just that transformation, it took a wrong turn in the opposite direction. Everyone knows that, for all its virtues, the Constitution—which George Washington thought “approached nearer to perfection than any government hitherto instituted among Men”—was nevertheless not perfect. It was born with the congenital flaw of slavery. As was almost inevitable in a nation that believed that all men are created equal but nevertheless allowed some men to hold others in perpetual bondage, it took a war to resolve the irreconcilable conflict, despite the increasingly desperate search for a peaceful compromise that consumed American politics from 1820 to 1850. After that stunningly costly war, the American people also fine-tuned their Constitution between 1865 and 1870 to undo its original sin, ratifying the Thirteenth Amendment to free the slaves, the Fourteenth to assure black Americans citizenship and civil rights, and the Fifteenth to prohibit any state from denying black citizens the right to vote.

But as early as 1873, the Supreme Court began to subvert the Fourteenth Amendment in the Slaughter-House Cases, in the process shredding the amendment’s key protections of the civil rights of Southern blacks. Going way beyond the particular grievances of the Louisiana butchers before it, the court declared that, while the amendment had indeed extended the Constitution’s protection of the privileges and immunities of citizens from federal infringement to protection against infringement by state governments as well, that new protection did not include all the rights that the amendment’s Framers had meant it to include: to own property; to have access to the courts; to pay taxes at the same rate as everyone else; to vote (subject to the qualifications of your particular state); to live, work, and travel where you want; and, above all, to have the protection of the Bill of Rights against state as well as federal violation. All the additional protection the amendment granted to freed slaves, as well as to other citizens, the court held, according to Epstein’s constitutional-law history (which could have been titled Constitutional Law Versus the Constitution), was the right to travel on interstate waterways and to petition the federal government for redress of grievances.

It’s worth noting, as Epstein observes, that when Chief Justice John Marshall declared in 1803 in Marbury v. Madison that “it is emphatically the province and duty of the judicial department to say what the law is,” he didn’t mean that it is the business of the Supreme Court, or a bare majority of it, to make the laws—and to the extent he implied that it might be, Epstein notes, he was wrong. But while the Court made that incorrect implication about its own omnipotence explicit in 1955 in Cooper v. Aaron, it had been moving in that direction for a very long time.

In 1876, United States v. Cruikshank made starkly clear just how unprotected the Supreme Court’s misrepresentation of the Fourteenth Amendment in the Slaughter-House Cases had left Southern blacks. After a Louisiana mob killed more than 100 freedmen and state authorities wouldn’t prosecute white murderers of blacks, the Supreme Court threw out the federal indictment of some of the murderers for conspiracy to deprive their victims of their constitutional rights, since the killers had violated no federal rights that extended to the states, the court held, with numerous citations of the Slaughter-House Cases. The decision helped embolden Southern Democrats to enact Jim Crow laws. From Cruikshank, it took but a short step to Plessy v. Ferguson, the infamous 1896 decision in which the Supreme Court obliterated still more of the rights that the Fourteenth Amendment had given blacks, by allowing the Southern states to legislate segregated transportation and schools and to outlaw interracial marriage. So much for Abraham Lincoln’s dream of finishing the work the Civil War had begun and binding up the nation’s wounds with malice toward none and charity for all.

As Madison was forging the Constitution into shape, its democratic character gave him his greatest worry, which he voiced in Number 10 of The Federalist Papers, only to assure Americans that the Constitution’s structure made that fear moot. According to the old, well-known tradition of political philosophy that lay behind the Constitution, the purpose of any government is to protect the citizens’ God-given rights to life, liberty, and property. But in a democratic government—even though the people would directly elect only congressmen, while the supposedly more prudent state legislatures would elect presumably wise and propertied senators and an electoral college the president—couldn’t the unpropertied majority vote to tax away the property of the small minority of rich citizens and give it to themselves? But that would never happen, Madison argued, because in the extensive republic that the Constitution would govern, so many different factions and interests would flourish that no single-minded majority could form that could tyrannize a minority by expropriating its wealth. Redistributive taxation, therefore, was a chimera.

Moreover, as Madison and Hamilton took for granted in The Federalist Papers, which they wrote (with five by John Jay) to urge ratification of the Constitution, taxes would chiefly take the form of import duties or excises on such commodities as whiskey—and these taxes, Hamilton asserted, were naturally self-limiting because if they grew excessive, people would stop buying the overtaxed article, and overall tax revenues would fall. In the unlikely event of an imposition of any direct tax on everybody, or on citizens’ land or wealth, as opposed to these indirect levies, Article I, Section 9 of the Constitution required that it be levied equally or proportionally, though scholars debate the meaning of that clause. But one thing the Framers never dreamed of was a tax on incomes. And for generations, they were right.

But in 1913, after 20 years of Progressive-era agitation, the Sixteenth Amendment, passed by Congress in 1909, won ratification. It imposed a graduated income tax—a direct tax that did not fall proportionally on all. Indirect taxes such as import duties and excise taxes, the argument went, fell disproportionately on the poor and provided too unpredictable a revenue stream to a federal government that Americans increasingly thought needed strengthening. Though the income-tax rates were but 1 percent for incomes up to $483,826, rising to a modest 7 percent on incomes over $11.6 million, the now-constitutional machinery for the tyranny of the majority that Madison had feared was fired up and ready to confiscate wealth as surely as the Stamp Act confiscated property. And since in 1913, the Seventeenth Amendment—instituting direct popular election of senators—also won ratification, the upper house no longer served, even theoretically, as a brake on the passions of the people.

Today, Madison’s nightmare has become America’s everyday reality. By 2010, according to the latest Congressional Budget Office data, the top-earning 40 percent of households paid 106.2 percent of federal income taxes, while the bottom 40 percent of taxpaying households paid minus 9.1 percent, thanks to such refundable tax credits as payments to those with low earned incomes. In addition, those 40 percent of households received such additional transfer payments from the wealth of their more prosperous neighbors as food stamps and Medicaid, plus Social Security and Medicare payments at a much higher proportion to what they paid in than do richer households. In 2011, according to Tax Foundation data, the top 5 percent of taxpayers paid 58.5 percent of total U.S. income taxes, while the bottom 50 percent paid 2.9 percent. And that’s just taxpayers. Transfers to non-income-tax-paying households on welfare can amount to twice what a minimum-wage job pays.

Much of what the Progressive Era had only hoped for, the New Deal brought into being, transforming America’s constitutional structure in ways that such Progressives as Woodrow Wilson, with his belief that the Founders were antique, bewigged figures with views unsuited to modernity’s more informed and effective age of science, statistics, and professionalism, had urged. Wilson, argues author Freedman, saw “the Founders’ checks and balances as an unnecessary drag on the efficiency of government,” which should be a vast mechanism in which expert bureaucrats with advanced degrees—working altruistically in nonpolitical agencies like the Interstate Commerce Commission, formed in 1887, or the Federal Trade Commission, founded during Wilson’s presidency—would smoothly institute what advances in economics and social science would reveal as the common good. In 1908, Wilson swept the Founders and their cobweb-covered Constitution into the dustbin of history. “No doubt a great deal of nonsense has been talked about the inalienable rights of the individual, and a great deal that was mere vague sentiment and pleasing speculation has been put forward as fundamental principle,” he wrote. By contrast with the Founders’ musty parchment, he continued, “Living political constitutions must be Darwinian in structure and practice.” Can’t get much more up-to-date and scientific than evolution.

And so arose the doctrine of the Living Constitution, which has now infringed nearly every guarantee of the Bill of Rights, from free speech to federalism. “The chief instrumentality by which the law of the Constitution has been extended to cover the facts of national development has of course been judicial interpretations—the decisions of courts,” Wilson wrote. “The process of formal amendment of the Constitution was made so difficult by the . . . Constitution itself that it has seldom been feasible to use it.” So the doughty courts have stepped in and taken over the “whole business of adaptation . . . with open minds, sometimes even with boldness and a touch of audacity,” becoming “more liberal, not to say more lax, in their interpretation than they otherwise would have been.” As Wilson saw it, writes Levin, “the federal judiciary was to behave as a permanent constitutional convention,” making up the laws as it went along. Of course, at that point, as Lincoln had warned almost half a century earlier, “the people will have ceased to be their own rulers.”

And indeed, it was this magic elixir of judicial constitution-making and rule by administrative agencies that Franklin D. Roosevelt employed to transmute the American political system into one that resembled George III’s system of rulers and subjects as much as it did George Washington’s government. The magnitude of the Depression, Roosevelt thought, required the federal government to seize control of the entire U.S. economy: only national rather than state or free-market solutions, he believed, could shake it back to health. The Supreme Court batted down his first attempts to use the Commerce Clause—the power that Article I, Section 8 of the Constitution gives Congress to regulate interstate commerce—to regulate all commerce, including commerce that never crosses a state line. In 1935, for example, the Court struck down a law mandating retirement plans for railway workers, noting that, even though railways participate in interstate transportation, their workers’ pension plans do not. That same year, the Court declared that Congress had no power, via the National Industrial Recovery Act, to set the wages and hours of Brooklyn poultry workers or to regulate how they sell chickens, since neither the workers nor the chickens leave New York State. Nor, said the Court the following year, could Congress set up commissions to decree coal prices or miners’ working conditions. Yes, strikes interrupt production, influence prices nationwide, and thus affect interstate commerce, but they and the conditions that cause them “are local evils over which the federal government has no legislative control.”

But once Roosevelt’s plan for a constitutional amendment to curb the Court’s power scared Justice Owen Roberts into changing his judicial spots, the Nine began to toe the New Deal line. Just as FDR’s Progressive cousin Theodore Roosevelt had blamed the global financial instability preceding the Panic of 1907 on giant corporations—often led, said TR, by “malefactors of great wealth”—Franklin Roosevelt also saw big business as a threat to ordinary individuals, whom only big government could protect. “We have earned the hatred of entrenched greed,” the president accusingly said of corporate America in his 1936 State of the Union speech. “Give them their way and they will take the course of every autocracy of the past—power for themselves, enslavement for the public.”

On cue, in its 1937 Jones & Laughlin decision, the Court upheld the National Labor Relations Act, whose “major function,” according to Epstein, “was to prop up union monopolies in labor relations.” To reach its decision, the Court noted that the big steel company had “far-flung activities” across the nation, so that “industrial strife” in any one of them “would have a most serious effect upon interstate commerce. . . . [I]t is idle to say that the effect would be indirect or remote. It is obvious that it would be immediate, and might be catastrophic.” Hence J&L’s intrastate activities “have such a close and intimate relation to interstate commerce as to make the presence of industrial strife a matter of the most urgent national concern. When industries organize themselves on a national scale, making their relation to interstate commerce the dominant factor in their activities, how can it be maintained that their industrial labor relations constitute a forbidden field into which Congress may not enter when it is necessary to protect interstate commerce from the paralyzing consequences of industrial war?” Further federalizing local economic activity, the Court declared in its 1941 Darby decision—with all the audacity Woodrow Wilson could have wanted—that of course the Fair Labor Standards Act could force firms not engaged in interstate commerce to observe national wage and hour standards, even though they were following the standards of their home states; and of course the FLSA could bar from interstate commerce any product it defined as “produced under substandard labor conditions.”

The logical but lunatic capstone to this line of reasoning was the Court’s 1942 Wickard v. Filburn decision. In accordance with FDR and his brain trust’s belief that the Depression stemmed from a crisis of deflationary overproduction, the Agricultural Adjustment Act, purportedly based on Congress’s Commerce Clause power, directed the Department of Agriculture to establish a crop-quota system, allocating so much production to each state, which would, in turn, prescribe the permitted output for each farm. For exceeding his wheat allotment, Ohio farmer Roscoe Filburn was fined $117.11, or 49 cents per each bushel of excess production. But here’s the rub: agriculture isn’t commerce, as the Founders understood it, and not only did Filburn’s grain not enter into interstate commerce; it didn’t even enter into in-state commerce, since he fed it to his own cows. But even if the grain is “never marketed,” the Court wrote, in true Alice in Wonderland style, “it supplied the need of the man who grew it which would otherwise be reflected by purchases in the open market. Home-grown wheat in this sense competes with wheat in commerce. The stimulation of commerce is a use of the regulatory function quite as definitely as prohibitions or restrictions thereon.” Even if Filburn’s “activity be local and though it may not be regarded as commerce,” the Court ruled, “it may still, whatever its nature, be reached by Congress if it exerts a substantial economic effect on interstate commerce.” The lengths to which free people will go to evade central planners’ price controls!

The New Deal didn’t transform the Constitution only by institutionalizing nine unelected judges with lifetime tenure as a permanent constitutional convention. It also allowed Congress to create, at the president’s request and with the blessing of the Supreme Court, an unprecedented regulatory state, made up of a constellation of administrative agencies, from the Federal Housing Administration and the Federal Communications Commission to the National Labor Relations Board and the Securities and Exchange Commission, which make rules, enforce them, and adjudicate transgressions of them. “The practice of creating independent regulatory commissions, who perform administrative work in addition to judicial work,” Roosevelt himself admitted, “threatens to develop a ‘fourth branch’ of Government for which there is no sanction in the Constitution.”

That is an understatement. It’s hard to count the ways in which the administrative or regulatory state overturns, abolishes, and replaces the Constitution. As the American Revolution’s tutelary philosopher, John Locke, had pronounced, “The legislative cannot transfer the power of making laws to any other hands: for it being but a delegated power from the people, they who have it cannot pass it over to others.” The legislative branch has the authority “only to make laws, and not to make legislators”—but that’s just what Congress’s establishment and expansion of the administrative state has made its rule makers.

In addition, these are legislators who execute the rules they decree and adjudicate and punish infringements of them, an egregious violation of the “separation-of-powers doctrine under the Constitution” that “dispens[es] with our principal safeguard against autocracy in government,” the American Bar Association warned in 1936, as the administrative state was taking shape. “We should not have some 73 midget courts in Washington, most of them exercising legislative and executive powers. A man should not be judge in his own case and the combination of prosecutor and judge in these tribunals must be relentlessly exposed and combatted.” Making matters worse, as even New Deal congressman Emanuel Celler ruefully noted, many of the “experts” staffing these agencies are “mere ‘whipper-snappers’—young students just out of law school—who apparently are given undue authority in originating, if not effectuating, final decisions.”

Worse still, the regulatory agencies may presume anyone they charge to be guilty unless he proves his innocence, and he has but limited standing and scope to appeal the agency’s decision to a real court, effectively “making the commission’s decisions on fact final and conclusive,” the ABA objected. “This sets the wheels of government moving in reverse gear; the servant becomes the master, and the right to earn a living becomes subject to the servant’s whim and caprice as he professes to apply some vague and variable statutory standard.” Little wonder that one congressman warned that “government by committees, boards, bureaus, and commissions will, if unchecked and uncontrolled, destroy the republican conception of government”—or that a senator deemed one of the agencies a “Star Chamber,” the arbitrary, juryless court of Stuart despotism. (These quotations come from a Northwestern University Law Review article by George B. Shepherd, cited in Howard’s book, on the evolution of the 1946 Administrative Procedures Act, “the bill of rights for the new regulatory state,” Shepherd says.)

Freedman sets forth an instructive example of how all this works in practice in a story with an unexpectedly and illuminatingly happy ending. In 2004, the Public Company Accounting Oversight Board (PCAOB, or “Peekaboo”) dispatched seven investigators to inspect a tiny Nevada accounting firm, combing over its files for two weeks and asking follow-up questions that took the three-man outfit 500 man-hours to answer. A year later, the board charged the firm with eight accounting deficiencies, demanding a response within 30 days. When the firm’s managing director, Brad Beckstead, tartly replied that such compliance costs and standards would kill small CPA firms, Peekaboo summoned him for three days of questioning, demanded more files plus correspondence and e-mails, and ultimately found nothing to charge the firm with—but not before its profits were down 60 percent.

With the help of the nonprofit Free Enterprise Fund, Beckstead found grounds to sue. The Constitution, he argued, calls for a “unitary executive,” meaning that all executive-branch officials must be responsible to the president, who is, in turn, responsible for their and his performance to the voters. The members of the board—who in 2003 received salaries of $400,000 each, with $556,000 for the chief, and who never have to ask for public funding, since they impose a tax on public companies and can levy fines of up to $15 million—can only be hired or fired by the SEC, and then only for serious cause. The same civil-service rules protect the SEC commissioners from dismissal at the president’s displeasure. So this executive-branch agency enjoys double protection from control by the nation’s chief executive, something that would have horrified Madison, who successfully argued in the first session of Congress that if the president didn’t have the power to fire executive-branch officials at will, that would “abolish at once that great principle of unity and responsibility in the Executive department, which was intended for the security of liberty and the public good.” All such officials, from the lowest to the highest, said Madison, “will depend, as they ought, on the President, and the President on the community.” No more, however, thanks to a then-conservative Supreme Court’s 1933 decision that FDR lacked the power to fire an FTC commissioner at will.

Beckstead lost at trial and on appeal but won in a 5-4 Supreme Court ruling in 2010, with Chief Justice John Roberts making the Madisonian observation that “the Executive Branch . . . wields vast power and touches almost every aspect of daily life,” so it mustn’t “slip away from the Executive’s control and thus from that of the People.” But it was a close call.

For a more up-to-date and less happy example, one need only look at a May 19 Wall Street Journal editorial on the Federal Energy Regulatory Commission and an accompanying op-ed by William S. Scherman, a lawyer representing subjects—“victims” might be a better word—of FERC investigations. According to Scherman and the paper’s editors, here is an agency that has turned into something like a shakedown racket. It charges participants in the energy market with “impairing, obstructing, or defeating a well-functioning market,” after carrying on secret and ill-documented investigations, the results of which it refuses to share with the subjects, demanding millions of documents, asking thousands of questions in as many as half a dozen interrogations (while refusing to let subjects review their previous testimony), and—worst of all—failing “to adopt a coherent or meaningful definition of market manipulation,” claims Scherman, so that “someone who follows rules created by FERC is somehow committing fraud at the same time.” Little wonder that those whom FERC charges prefer to settle rather than “fight with one hand tied behind their back,” as Scherman puts it. In five years, FERC has collected $1.23 billion in penalties, driven major players from the market, shrunk the market’s liquidity, and made energy more expensive and prices more volatile. The Obama administration now wants to make the commission’s chief investigator the new chairman of this modern-day Star Chamber. Thus are we transforming entrepreneurial into corporatist capitalism.

This same administration has made the regulatory state more unconstitutional than even FDR would have dared, Levin explains. Among the 150 new agencies and commissions that the Obamacare law has created, there is one, the Independent Payment Advisory Board—the notorious “death panel”—that no future Congress can abolish unless it does so within a seven-month period in 2017 by a three-fifths vote in both houses. After that, the people’s elected representatives lack authority so much as to alter a board proposal. In the same spirit, the Dodd-Frank Act sets up a Consumer Financial Protection Bureau, with a budget that Congress is forbidden to review, and a Financial Stability Oversight Council, whose decisions no affected business may challenge in court, period. And now, while another such agency, the IRS, stonewalls the people’s representatives, the SEC has the gall to sue them.

“The current system is a form of tyranny,” concludes Howard. Like “a giant legal mudslide, [it] has buried both the framework of law and our freedoms.” By no means “is it a government by the people.”

What, then, should we do? Start with Epstein’s solution, slightly different from the others because he is a lawyer trying to mold the thinking of judges and law professors about judging constitutionally. Not only liberal exponents of the Living Constitution but also conservative jurists, says Epstein, tend to think of the American Constitution as analogous to the British: “a kind of Burkean evolution whereby the text itself becomes modified through repeated usage—usually towards big government.” But for a Constitution with a built-in mechanism for change by amendment, such an analogy is mistaken. The accumulated rulings of Supreme Court justices are not part and parcel of the Constitution but often the piling of error upon error, “and the layers of interpretive confusion are so great” that such an approach does “much harm.” But because even erroneous interpretations—and thus modifications—of the law acquire a certain Burkean prescriptive authority, the question that Epstein proposes to answer is: “How should judges respond to perceived mistakes in the prior decisional law?”

My instinct, along with Freedman’s, is to follow law professor Raoul Berger’s definition of constitutional law as “the Constitution itself, stripped of judicial encrustations.” But Epstein is more moderate. To maintain the mystique of “a sound constitutional order” on which governmental legitimacy rests, you can’t just junk generations of rulings with originalist abandon. But you also don’t have to follow blindly the principle of stare decisis (deference to prior rulings) that made the Supreme Court’s landmark 1954 ruling in Brown v. Board of Education so mischievous for subsequent jurisprudence—because it reached the right result through fanciful reasoning, since the Court lacked courage to overrule explicitly Plessy v. Ferguson’s assertion of the constitutionality of “separate but equal” treatment of the races and to declare that the Fourteenth Amendment doesn’t permit governmental or public-accommodation discrimination by race, period (thus also forestalling affirmative action). Epstein would advise judges to pick and choose what they overrule not by strict originalism but always working to uphold the Constitution’s underlying Lockean, classical liberal “tradition of strong property rights, voluntary association, and limited government,” along with the “protections of the separation of powers, checks and balances, federalism and the individual rights guarantees built into the basic constitutional structure.”

All fine—but only as long as the Court has enough justices able to think in such terms. I’d add that, as long as the Court is willing to consider originalist constitutionalism, the more conservative lawyers, legal foundations, and philanthropists willing to bring and support cases like NFIB v. Sebelius against Obamacare or Citizens United v. FEC, the better.

Rejecting such incrementalism as too little, too late, especially since we could easily end up with another New Deal- or Warren-style Court, the other three authors opt for amending the Constitution to restore its original integrity, using Article V’s provision to allow two-thirds of the state legislatures to call a constitutional-amending convention, since a hidebound Congress, with its emanations and penumbras of lobbyists and activists, would never act to limit its powers and perks. Three-fourths of the states would then have to ratify the resulting amendments in the usual way—though one of Levin’s amendments creates a streamlined process that requires only two-thirds of the states to ratify. The three authors’ 13 very reasonable suggested amendments overlap, so without getting lost in the details, let me set forth the essentials of what they want to accomplish.

All three seek to let two-thirds of the state legislatures repeal the tangle of outdated or unconstitutional laws and absurd regulations by which, as Alexis de Tocqueville wrote, men are “constantly restrained from acting” and that “enervates, extinguishes, and stupefies a people, till each nation is reduced to nothing better than a flock of timid and industrious animals, of which government is the shepherd.” Some writers suggest a committee, whether of government officials or outsiders, to do the same thing, or at least to recommend action (and a philanthropy-backed, Howard-led group should start the job now, since bland regulatory language often needs careful scrutiny to find power-mad regulatory intent). A sunset law on all legislation and regulation, unless expressly renewed every 15 years, might be another way of cutting through the tangle.

The Environmental Protection Agency—yes, we never stop spewing out New Deal–style agencies—and the Endangered Species Act are prime targets here. These writers can’t see why environmental reviews by the Coast Guard or the Army Corps of Engineers, along with Indian tribes from Nebraska and Oklahoma, should have held up for three years (and still counting) the modernization of a New Jersey bridge that would save $3 billion over the cost of building a new one. They don’t see why the EPA and the Army Engineers can tell a developer not to move sand from one place on his property to another without a permit, because of its potential impact on a navigable waterway 20 miles away—and to seek to jail him for five years before he settled, a shakedown by the federal government’s intrusion into a purely intrastate land-use issue that the Tenth Amendment should have protected him from. Howard says, “I am sometimes asked after speaking, ‘Are you in favor of pollution?’ ” The right answer is no—but if my choice is pollution or tyranny, I’ll take pollution.

To prevent a perpetual caste of rulers, these writers want a term-limit amendment for congressmen, senators, and even (says Levin) for Supreme Court justices, whose rulings in the meantime he’d let a three-fifths majority of both houses of Congress overturn. As another way to stop courts from being a tool of oppression, harassment, and delay, Howard would like an amendment forbidding lawsuits without a judge’s prior determination of their reasonableness. To stop the governmental orgy of taxing and spending, these authors favor a federal balanced-budget amendment, a line-item veto for the president, and perhaps even a constitutional upper limit on the allowable income-tax rate. To get control of the unelected, unaccountable bureaucracy, they recommend restoring the president’s authority to hold apparatchiks to account by firing them—or else face the ire of the voters whom he hasn’t protected from their insolent and often unconstitutional meddling.

To restore federalism and keep the federal government from usurping powers reserved to the states and the people, Freedman and Levin want to return to election of senators by state legislatures—ensuring, they believe, that the senate would safeguard state interests. I can’t help recalling those Gilded Age senators who bought their offices from venal state legislators, but perhaps, given the Founders’ views of human motivation, such senators would nevertheless serve the original purpose of protecting property against the tyranny of the majority. Levin would like to reinforce such protection by amendments explicitly underscoring what Article I’s Commerce Clause and the Takings Clause of the Fifth Amendment already say—a sad commentary on how thoroughly the Living Constitution has murdered the Founders’ Constitution.

You have to define a problem before you can solve it. We owe each of these four authors a debt for starting a conversation that could forestall a crisis of legitimacy.