The last day of July 2025 was D-day for Florida’s local governments. That was when the state’s new Department of Government Efficiency, modeled on Elon Musk’s federal DOGE, began descending on city halls and county administrative offices to audit spending as part of Governor Ron DeSantis’s drive for “transparency and accountability in government.” His administration dispatched two teams of fiscal specialists from Tallahassee—including experts from the Departments of Revenue, Financial Services, and Education—in what he called a “boots-on-the-ground” effort to rein in local government spending. To justify the campaign, DeSantis argued that, with Florida’s growing prosperity, local governments were using revenue from rising tax receipts, especially property levies, to go on a “spending spree.” The state DOGE’s purpose, he said, was to find out what elected officials were doing with all that new money.

Like Musk’s DOGE, DeSantis’s Florida auditors met with both cheers and protests. Some 100 demonstrators—including members of the NAACP, a teachers’ union, and the Democratic Socialists of America—gathered outside Gainesville City Hall holding signs proclaiming, “City of Gainesville: Do Not Capitulate!” Undeterred, DeSantis warned municipalities to expect similar visits. “Florida is the model for fiscal responsibility at the state level, and we will utilize our authority to ensure local governments follow suit,” he said.

Finally, a reason to check your email.

Sign up for our free newsletter today.

While DeSantis’s auditors drew headlines, they were hardly alone. Across the country, state-appointed investigators were undertaking comparable missions. Taking a cue from Musk’s drive to expose waste, improve transparency, and streamline the federal bureaucracy, officials in roughly two dozen, mostly Republican, states announced early in the second Trump administration that they would create their own watchdog task forces and pursue laws to curb state and local regulation costs.

Some states, Florida included, moved fast. They deployed AI to identify obsolete or overlapping rules, traced Social Security numbers to recover benefits still flowing to the dead, canceled outdated contracts and leases, merged redundant agencies, and audited localities. As with the federal version, their work has sparked controversy—especially among groups that depend on public funding, including public employees and their unions. Local politicians in both parties are wary, unsure whether the push for “efficiency and transparency” will expose corruption or simply shift power.

The state DOGE movement is another sign of how local government policies are diverging as state politics becomes dominated by one party or another. During the pandemic, Republican-leaning states cut taxes to spur economic recovery, while Democratic states raised them to fund more spending. Those contrasting strategies have persisted post-Covid. The DOGE initiatives mark a further expression of this divide, with some governors openly saying that they will use savings from government audits to avoid tax hikes and, where possible, to slash taxes further. “Today, I’m launching DOGE-OK to keep the focus on flat budgets and limiting government,” Oklahoma governor Kevin Stitt said in early 2025, pledging to scrutinize “any spending more than a ham sandwich.”

The push for the federal DOGE resulted from mounting reports of fraud and waste in Washington. A 2024 Government Accountability Office study estimated annual losses, including payments to people ineligible to receive them, at between $233 billion and $521 billion. Inspectors general detailed how fraud had surged during Covid-era aid programs, with as much as $200 billion potentially stolen from the Small Business Administration’s pandemic loan program alone. A key culprit, they noted, was agencies’ failure to comply with the Payment Integrity Information Act of 2019, which required them to assess and correct risks of fraud and overpayment.

These revelations emboldened Musk to predict that DOGE could save taxpayers $1 trillion, a figure that proved far too optimistic for the brief period the task force operated. Even so, during its short life span, DOGE uncovered numerous examples of Washington’s careless spending. It exposed the misguided funding priorities of the U.S. Agency for International Development—including grants of $20 million to improve civil society in Sudan, $19.6 million to expand “inclusive” politics in Tanzania, and $1.7 million for “reproductive health, gender support for displaced persons in Pakistan.” The disclosures eventually led Trump to dismantle USAID, a Cold War relic. DOGE also canceled thousands of questionable government contracts across multiple agencies, including consulting agreements for “cost-saving” tech support that cost more than it saved. Musk’s team voided hundreds of leases for unused government properties, recommended agency consolidations that slashed payrolls by roughly 26,000 positions, and terminated scores of licenses and rental agreements for phones, computers, Internet service, credit cards, and other goods and services that no one was using.

Though Musk’s initiative focused on federal agencies, state governments also came under scrutiny. While Washington funded many local Covid aid programs, states often administered them, and many fell prey to scams. California’s state auditor found that the government had failed to verify a majority of unemployment claims during the pandemic, making the state a prime target of organized fraud that cost an estimated $20 billion. Audits in Kentucky, Georgia, and Michigan projected that one in every four unemployment insurance dollars the governments distributed during the pandemic went to cheats. New York State is trying to recover roughly $4 billion in unauthorized payments from the same program. The failures were so extensive that Congress extended the statute of limitations for pursuing fraud, giving states more time to recoup losses and prosecute the scammers. Meantime, more recent disclosures about widespread fraud in public-assistance programs in Minnesota further underscore the need for greater vigilance from state governments on taxpayer-funded programs.

Given these revelations, some governors had an immediate reaction to the news that Trump would appoint Musk to lead a task force on government efficiency. Before Trump took office, Republican governors sent him a letter endorsing DOGE. They noted that states must balance budgets and live within their means and that it was “past time for Washington to live within its means, too.” Observing that the top states for migration, economic growth, and housing affordability were increasingly Republican, the governors credited cost-cutting, deregulation, and lower taxes for their success. They pledged support for Trump’s push to bring analogous discipline to Washington.

Several weeks later, Iowa governor Kim Reynolds told a House panel on government efficiency: “Like most Americans, I’m thrilled by the priority President Trump is placing on shrinking government and making it work better.” She announced an Iowa version of DOGE to extend the cost-cutting she had undertaken in her first term, focusing on savings that would enable meaningful reform of local property taxes.

New Hampshire’s newly elected governor, Kelly Ayotte, used her inaugural address to launch a state COGE—commission on government efficiency—declaring it necessary “because I know nothing is harder than getting politicians to not spend money.” Oklahoma’s Stitt said that rooting out waste and inefficiency through a DOGE would be essential to making Oklahoma a Top Ten state for attracting businesses and residents. In Texas, Governor Greg Abbott established the Texas Regulatory Efficiency Office in April. A 2022 study ranked Texas as the fifth most regulated state in America. The four states ranking as more regulated were governed by Democrats. “Among the CEOs I talk to every single week, there are growing and recurring concerns that the regulatory environment in Texas is becoming too burdensome,” Abbott said. To head the office, Abbott appointed the executive director of the Texas Public Policy Foundation, a local think tank that promotes “liberty, personal responsibility and free enterprise.”

Democrats didn’t leave the reform field entirely to Republicans. The Democratic Governors Association, for instance, noted that Pennsylvania governor Josh Shapiro was working to speed up economic-development projects and that Governor Jared Polis had led an initiative to eliminate outdated executive orders on energy in Colorado. Still, Democrats were hamstrung on the issue, since large parts of their coalition—especially public-sector unions and community groups that benefit from spending programs—opposed DOGE-style plans. The union-backed, left-leaning Economic Policy Institute argued that state DOGE efforts amounted to Republicans “weaponizing efficiency.”

Some states launched their reforms quickly by modeling their approach on the federal DOGE. Oklahoma began by scrutinizing state contracts, leases, and benefits payments, and then enumerating its savings online. The state’s disability program started monitoring Social Security numbers and scanning local obituaries to identify deceased claimants, nixing some $3.9 million in payments. Oklahoma’s DOGE also shut off unused “legacy” phone services that the state was still paying for, reducing that state’s annual phone bill by nearly $2.2 million. The state claimed millions of dollars in personnel savings from consolidating operations and shrinking staff at departments ranging from the Oklahoma Medical Marijuana Authority to the Department of Labor. The reductions reflect Governor Stitt’s pledge to leave office with fewer people employed in state government than there were when he arrived. Within six months, the state had listed some $75 million in savings through these and related moves.

Some governors have adopted a broader, longer-term vision for DOGE. Early in her tenure, Iowa’s Reynolds consolidated state government from 37 agencies to 16 and eliminated one-third of the state’s boards and commissions. Through the state DOGE, she has created a commission of private-sector Iowans tasked with finding ways to restructure local government to reduce municipal costs and rein in property taxes. Many of the proposals would require legislative approval rather than executive action or contract revisions. One idea is to reduce the number of county governments in Iowa—currently 99, a notably high figure for a state with only 3 million residents. Alternatively, the commission might let some cities operate independently to eliminate overlapping services. “We do not intend to nibble around the edges. We hope to make bold recommendations to move the needle of efficiency in our government,” the head of the Iowa DOGE’s Return on Taxpayer Investment subcommittee said.

He also called rising local property taxes the “elephant in the room” for the commission. The difficulty of implementing such proposals became clear when word leaked that the group was considering aligning public-sector compensation with private-sector pay and practices, including shifting the state’s defined-benefit pension system, burdened by large liabilities, to a 401(k)-style savings plan. Sounding much like Democrats, Republican legislative leaders quickly voiced opposition.

A state DOGE has also become a key weapon in Governor DeSantis’s fight against climbing property taxes. As Florida’s economy has boomed, he points out, property owners have been hit with soaring assessments, requiring them to pay more on the increased value of their homes—what he likens to a tax on unrealized capital gains. Over the past four years, property-tax collections in the Sunshine State have risen 46 percent, a 10 percent compound annual growth rate. DeSantis is pursuing reform through a potential November 2026 ballot measure to lower rates statewide. “You have to continue writing a check to the government, every year, just for the privilege of being able to use property that you supposedly already own,” the governor said.

Meantime, DeSantis has used DOGE to spotlight the issue. Among other measures, auditors have asked local governments to provide information on programs funded under the banners of “diversity, equity, and inclusion” or the “Green New Deal,” with the goal of determining how those funds are spent. The Florida DOGE has already subpoenaed government workers in Orange County who resisted testifying about its DEI spending, and it accused Pensacola city government of “reckless” spending on DEI initiatives, including $150,000 on a drag show at a local theater. Though there has been some pushback, several dozen local governments—perhaps recognizing growing public anger over property taxes—say that they welcome the audits. Jacksonville has launched its own DOGE, charged with identifying agencies and services expanding faster than budget projections and reviewing municipal contracts for redundancy. The city has faced criticism for the rapid budget growth, with Florida chief financial officer Blaise Ingoglia issuing a report claiming that Jacksonville’s spending has increased $200 million “above the amount that would account for population growth and inflation.”

The state DOGE movement has evolved alongside a parallel endeavor, especially in Republican-led states, to limit the growth of costly regulations, particularly those originating from the administrative state. In 2025 alone, five states have passed so-called REINS (Regulations from the Executive in Need of Scrutiny) laws, based on a proposed federal bill, backed by Republicans. That bill—which would require congressional approval for any major agency rule with an economic impact exceeding $100 million—was first introduced in 2009 and has been re-proposed in every congressional session since, though it has never passed. Now, with the new deregulatory enthusiasm sweeping states, local REINS laws are proliferating. Oklahoma, for instance, enacted a legislative package in 2025 to constrain regulations. Any rule proposed by a state agency with compliance or implementation costs exceeding $1 million—as determined by the Legislative Office of Fiscal Transparency—must now obtain legislative approval. Another change targeted “judicial deference.” The legislation followed the U.S. Supreme Court’s 2024 decision ending so-called Chevron deference, the idea that federal courts should yield to government agencies in forming regulations. Oklahoma legislators wanted to ensure that state courts would not continue deferring in the wake of the Court’s ruling. Similarly, Texas included a provision in its law establishing DOGE stating that local courts needn’t yield to state agencies’ interpretation of local laws.

Like DOGE, REINS legislation has become a partisan flashpoint, strongly opposed by many Democrats and left-leaning advocacy groups. In two states that adopted such laws in 2025—North Carolina and Kentucky—Republican lawmakers overrode vetoes from Democratic governors. North Carolina’s law, opposed by Governor Josh Stein, requires a cost-benefit analysis of any new regulation and legislative approval if the projected cost exceeds $20 million over five years. The measure also applies to rules issued by commissions and state boards. Kentucky’s legislation, approved over Governor Andy Beshear’s veto, uses a much lower threshold of just $500,000 in economic impact to trigger a required legislative approval.

With the 2025 legislation, nine Republican-controlled or Republican-leaning states now have some form of REINS laws, including Kansas, Utah, Indiana, and Florida. Kansas’s measure, enacted in 2024, passed over the veto of Democratic governor Laura Kelly, who argued that it would “interfere with the timely implementation of necessary and important rules and regulations . . . for the protection and safety of Kansans.”

This drive to control spending and shrink the size and reach of government is the latest way that Republican-led states are distinguishing themselves from those governed by Democrats. During Covid, state policies often diverged sharply, with Republican states generally imposing fewer restrictions and lifting them more quickly than their Democratic counterparts. Those differences showed up in migration patterns—with key Democratic states that enacted the longest lockdowns losing citizens—and also in economic terms, with red states recovering in general far more quickly than their blue counterparts.

The trend toward deregulation and cost-cutting exemplified by state DOGE efforts emerges as the tax gap between red and blue states grows larger. During the pandemic, several large Democratic-led states used fiscal emergencies to justify tax hikes, while many Republican states moved to cut taxes once it became clear that the economy would rebound faster than expected from Covid-era shutdowns. New York, for instance, passed a whopping $4.3 billion increase in corporate and income taxes early in the pandemic, while New Jersey boosted its top tax rate on high-income individuals to the tune of nearly $400 million, and Massachusetts added a surcharge on high earners projected to raise $1 billion, even as local news reports described state government as “awash in cash.” By contrast, for fiscal year 2021 alone, 11 largely Republican states cut income-tax rates, and five reduced corporate taxes.

Since then, Republican locales have kept trimming levies and shrinking costs. A total of nine states—including Indiana, Mississippi, Missouri, and West Virginia—slashed income taxes in 2025. These followed reductions in 14 states the previous year, including GOP-leaning Georgia, Iowa, and Kentucky. Meantime, Democratic-controlled Maryland raised taxes on residents earning more than $500,000 in 2025, and Rhode Island introduced a new levy on vacation homes—dubbed the “Taylor Swift tax” because she owns a property there. In Washington State, Democrats hiked the capital-gains tax and expanded the business-and-occupation tax, a move projected to generate more than $1 billion annually.

Further distinguishing themselves from Democrats, several Republican-led states are pursuing more ambitious plans to eliminate income taxes altogether. Mississippi is phasing in a series of tax cuts that could ultimately end the levy. Oklahoma lawmakers have advanced a bill to reduce rates gradually if revenue from other sources keeps growing, with the goal of eventual elimination. Georgia is studying abolishing its income tax, noting that neighboring Florida and Tennessee already have none. “Among Southeast states, only South Carolina currently has a higher income-tax rate than Georgia,” Lieutenant Governor Burt Jones noted. “If we wish to remain the No. 1 state for business and keep our state competitive, we must expand on the progress made over the past four years to eliminate Georgia’s income tax.”

The Republican push to deregulate marks a deeper shift in how states are governed. In the early 1990s, most states split power between the parties; now, 38 are controlled entirely by one side. That divide has sharpened differences in taxes and regulation. Democratic governors have denounced Trump-era cuts and DOGE-style audits, citing them as reasons to raise taxes. Republicans, by contrast, have embraced the audits and even sent back unspent federal money—like the $878 million that DeSantis rejected over “ideological strings.” The spread of state DOGE programs is widening the policy gulf between red and blue America.

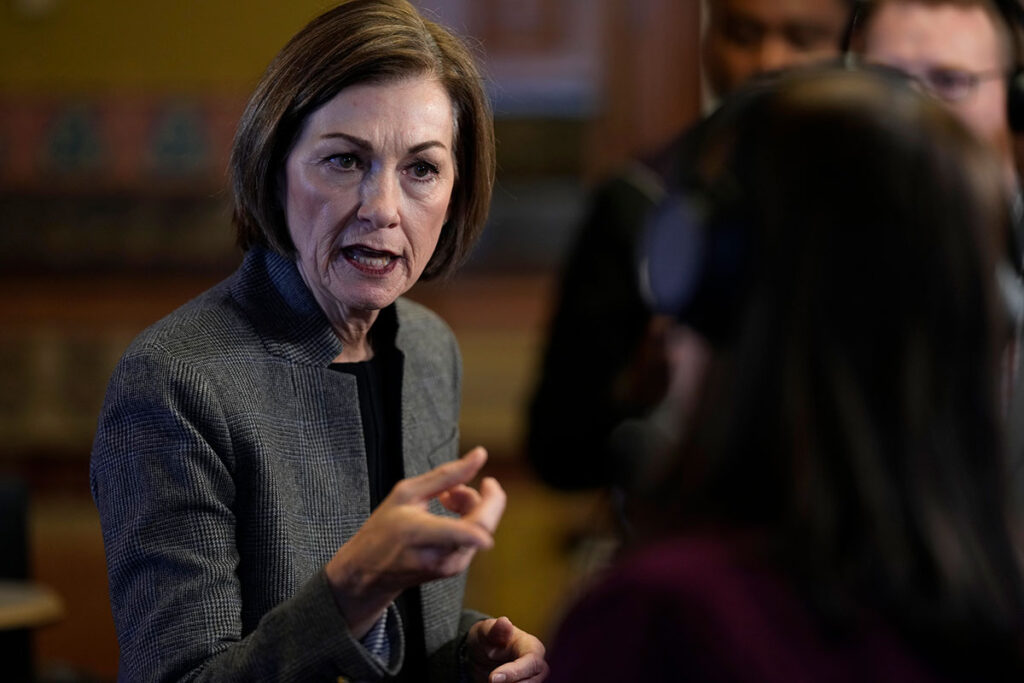

Top Photo: An anti-DOGE protest in Florida, where Governor Ron DeSantis made an ambitious push to find out what elected officials were doing with new revenue from rising tax receipts. (Douglas R. Clifford/ZUMA Press/Newscom)